FTSE-100-listed retailer Frasers Group PLC (GB:FRAS) today announced that it increased its stake in Boohoo Group PLC (GB:BOO) to 15.1%. The recent investment values Frasers’ stake at £56.6 million based on Friday’s closing price. The move follows the company’s other recent investments in Boohoo. In September, the company raised its stake to 9.1%, followed by an increase to 10.4% and to 13.4% earlier this month.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In 2023, Frasers also increased its stake in Boohoo’s competitor, ASOS PLC (GB:ASC), reaching 19.3% in August. These strategic investments align with Frasers Group’s approach of identifying appealing retail enterprises and making strategic investments in them.

Frasers Group is a well-known retail company founded by billionaire Michael Ashely as Sports Direct in 1982. The company owns a diverse range of famous brands covering clothing, sports, and other lifestyle products.

What is the Forecast for Boohoo Shares?

Boohoo Group is an online retailer of fast fashion products in the UK, catering to customers in the 16 to 40 age range. The share price of Boohoo Group rose by 1.85% today after the news. Recently, Boohoo’s stock was hit hard after the company issued a profit warning for FY 2023 due to lower demand for its products. The company posted a 17% decline in its revenue and a 12% fall in adjusted EBITDA. Post-profit warning, the company’s stock also received rating downgrades, which further impacted the stock.

Nonetheless, few analysts are optimistic about the long-term aspects of the stock and expect favourable numbers when demand conditions improve.

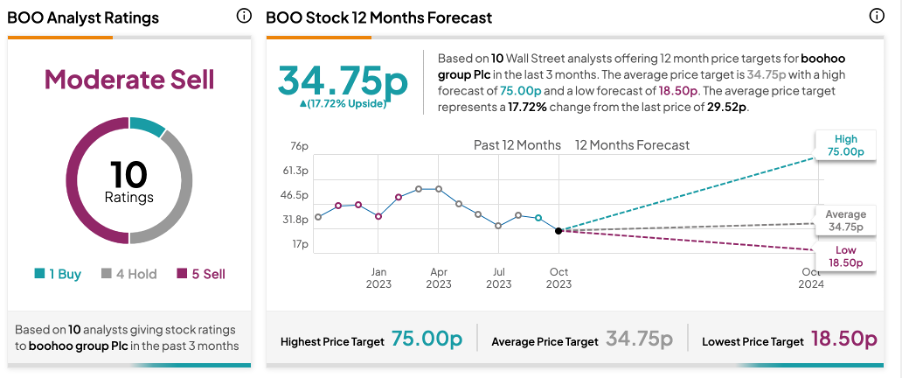

As per the consensus on TipRanks, BOO stock has been assigned a Moderate Sell rating. It is based on five Sell, four Hold, and one Buy recommendations. The Boohoo share price target is 34.75p, which is 17.7% above the current level.