FTSE 100 constituent B&M European Value Retail SA (GB:BME) has secured 51 Wilko outlets in a rescue deal worth £13 million. This move comes as administrators of struggling retailer Wilko work hastily to finalize additional deals, putting the jobs of thousands of employees in jeopardy. The administrators from PwC also confirmed the closure of 52 unwanted stores next week, resulting in more than 1,000 job redundancies.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

B&M is a retail chain in the UK, offering customers top-selling products under the grocery and other general product categories, all at budget-friendly prices.

The Backdrop

In August 2023, Wilko Limited went into administration after it was unable to find a buyer for its financially troubled business to stabilize its operations. This directly puts its 400 stores and 12,500 jobs at risk. Since then, the administrators at PwC have been in discussion with various buyers.

The administrators are also engaged in discussions with Doug Putman, a Canadian entrepreneur who is considering acquiring 200 stores. Other potential buyers include Poundland, Home Bargains, and The Range.

Yesterday, B&M emerged as the first suitor to acquire some of its stores, which aligns with its expansion strategy. The company has affirmed that the financing for this acquisition is fully provided by its existing cash reserves. Further, the company has no plans to retain the Wilko brand name. B&M will provide further updates on this deal in its half-year earnings report due in November 2023.

What is the Target Price for B&M Shares?

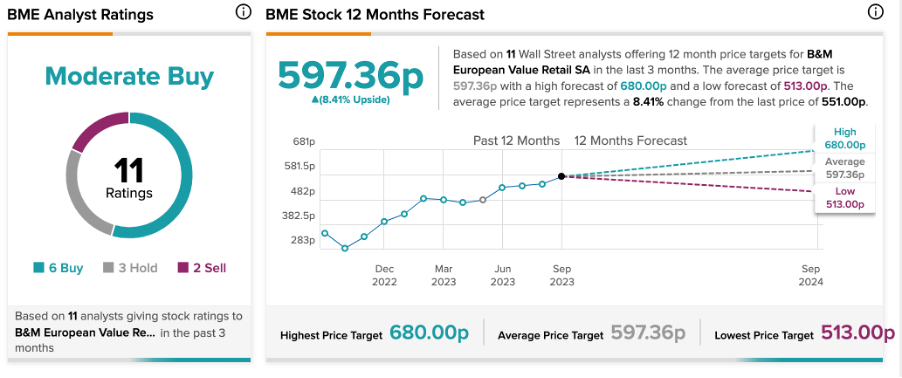

According to TipRanks, BME stock has a Moderate Buy rating based on a total of 11 recommendations. This includes six Buy, three Hold, and two Sell ratings.

The B&M share price target of 597.4p is 8.4% higher than the current trading level.