UK-based Ashtead Group PLC’s (GB:AHT) share price declined by over 2% today after the company announced its Q1 earnings with profit growth but a weaker outlook. The company posted an 11% increase in adjusted pre-tax profits to $615 million for the first quarter that ended on July 31, 2023. The decrease in share price could be linked to a decline in UK revenue, which amounted to £177 million in 2023, compared to £181.8 million the previous year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Ashtead share price was trading down by 2.9% at the time of writing as investors continued to process the numbers. As a result, the stock was positioned among the top daily decliners on the FTSE 100 index. However, despite this downturn, Ashtead continues to hold its position as the top-performing stock, with over a 150% return in the last five years.

So far in 2023, the shares have gained 15.5%.

Ashtead Group operates as a service company that specializes in renting construction and industrial equipment to a wide range of customers.

First-Quarter Results

During the first quarter, the company’s revenues grew by 19% to $2.7 billion, as compared to £2.2 billion last year. This was mainly driven by its revenues from the U.S., which increased by 22%, and its overall rental revenues, which were 16% above last year’s numbers. The company added 40 new locations in North America, which enabled it to tap the opportunities in this market. The EBITDA for the group increased by 18% to $1.23 billion.

On the flip side, UK revenues were down from £181.8 million to £177.7 million. The company highlighted challenging business conditions in the UK market, attributed to inflationary pressures that have eroded its profit margins. The company’s UK operating profit experienced a sharp decline of 39%, totalling £16 million.

As a result, it revised its full-year UK rental revenue growth projection to a range of 6%-9% growth. This adjustment is lower than its earlier guidance range of 10%-13%. Although this is disheartening, it’s worth noting that the company now derives more than 90% of its revenues and operating profits from North America.

Are Ashtead Shares a Good Buy?

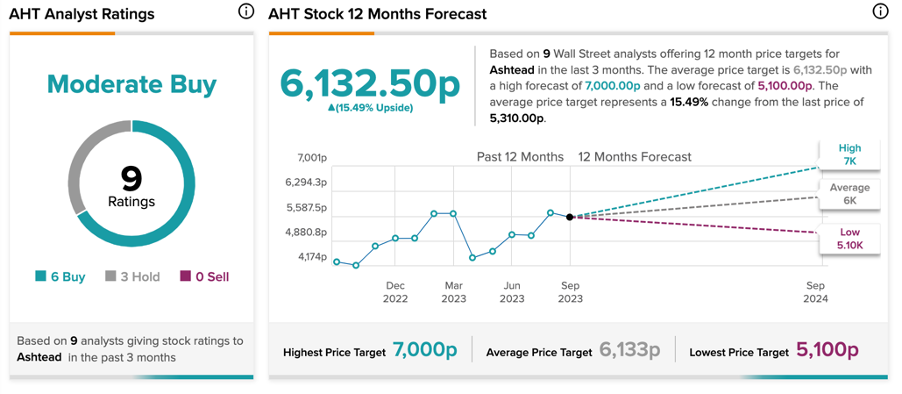

On TipRanks, AHT stock has a Moderate Buy rating based on six Buy and three Hold recommendations. The Ashtead share price target is 6,132.5p, which is 15.5% higher than the current trading level.

It’s worth noting that these ratings were provided prior to earnings and may be subject to change after analyzing the company’s performance.