FTSE 100-listed company WPP PLC (GB:WPP) revised its 2023 revenue guidance to the lower side as the company witnessed reduced spending by its technology clients in the U.S. Overall, the company posted revenue growth of 6.9% in the first half of 2023. For the full year, the company anticipates revenue growth to fall within the range of 1.5% to 3%. This forecast is lower than the previously stated range of 3% to 5%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the announcement, the shares began trading in negative territory and have experienced a decline of more than 6.17% so far today at the time of writing. This further contributes to the existing loss of over 20% over the past six months.

The Hits and the Misses

The company’s pre-tax profits for the first half of the year dropped by over 50% to £204 million from £419 million in the corresponding period of 2022. The operating profit was also down by 43.2% to £306 million.

The growth outside of the U.S. picked up to mid-single digits, while China experienced growth that was, however, not as robust as anticipated. The numbers were in line with those of its industry peers, who have faced similar impacts as U.S. companies trim down their marketing budgets. WPP’s UK-based competitor company, S4 Capital PLC (GB:SFOR), recently announced its trading update for the first half of 2023. The company witnessed slower sales and also reduced its full-year revenue growth target to 2-4%, compared to the previous range of 6–10%.

On the plus side, the company’s new business performance was a hit. The company posted $2 billion in net new billings in the first half, with a solid pipeline for the remaining half. The company’s ongoing transformation program is moving ahead as planned and is anticipated to yield annual savings of £450 million in 2023.

The company also announced an interim dividend of 15p, similar to what was declared in the first half of 2022.

What is the Price Target for WPP?

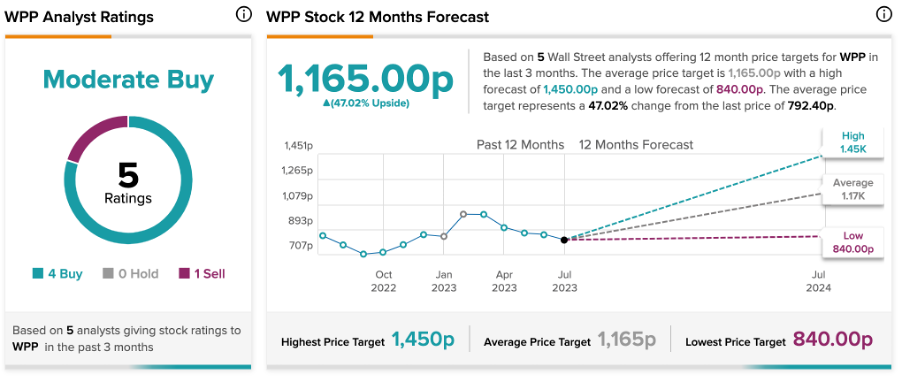

Based on the analyst consensus from TipRanks, WPP stock has received a Moderate Buy rating, supported by four Buy and one Sell recommendations.

Analysts have set an average target price of 1,165p, indicating a projected growth of 47% from the current level.