UK-based British Land Company (GB:BLND) and Dr. Martens PLC (GB:DOCS) reported their full-year earnings for 2023. Despite tough economic conditions, both companies posted decent numbers and rewarded shareholders with higher dividends.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

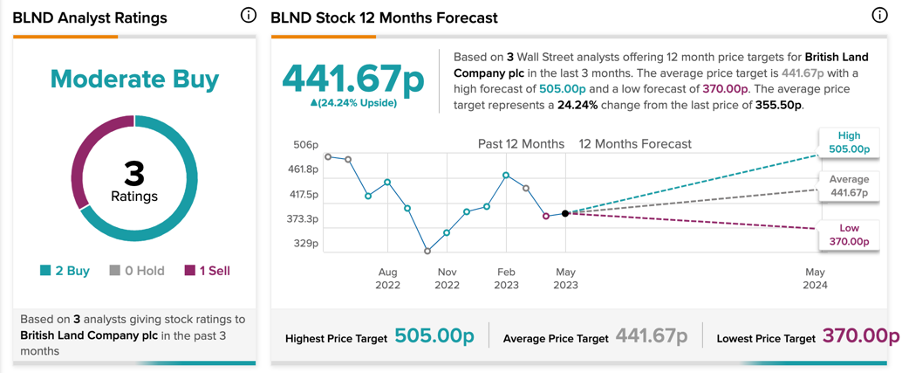

Analysts have assigned a Hold rating to Dr. Martens, whereas British Land has been given a Moderate Buy rating.

Let’s explore this further.

Dr. Martens PLC

Dr. Martens is a UK-based brand involved in the production and distribution of footwear products. The company’s product range includes boots, shoes, sandals, and other shoe care products.

Yesterday, the company reported its full-year earnings for 2023. Despite the company achieving revenue exceeding £1 billion for the first time, it still experienced a 29% decline in profits. During the year, the company’s direct-to-customer strategy in EMEA and Japan worked in its favor. However, the tough operational conditions and higher costs in the U.S. market resulted in lower profits.

Dr. Martens announced a final dividend of 4.28p, maintaining the same level as the previous year. This resulted in a total dividend of 5.84p, reflecting a 6% increase. Additionally, the company intends to initiate a £50 million share buyback program.

The company’s stock went down by almost 12% on Thursday after the results announcement.

Dr. Martens Share Price Forecast

According to TipRanks’ analyst consensus, DOCS stock has a Hold rating based on three Hold and one Buy recommendation.

The average share price forecast is 185.3p, which is almost 34.4% higher than the current price level.

British Land Company PLC

British Land is a leading real estate development and investment company in Europe with a strong portfolio of commercial properties.

In May, the company reported strong numbers in its 2023 earnings report. It posted an underlying profit growth of 6.9%, driven by efficient cost-control measures that kept administrative costs flat during the year. The development pipeline is highly promising, with 1.8 million square feet of space already committed.

The company’s full-year dividend stood at 22.64p per share, which was 3.3% above last year’s payments. The company carries an appealing dividend yield of 6.38%.

14 days ago, Neil Green from J.P.Morgan reiterated his Buy rating on the stock anticipating a potential growth of more than 40% in the share price.

British Land Stock Price Forecast

BLND stock has a Moderate Buy rating on TipRanks, based on two Buy and one Sell recommendations. At an average price forecast of 441.67p, analysts predict an upside of 24% in the share price.

Conclusion

British Land has impressed analysts with solid 2023 results and higher dividends for shareholders. On the other hand, Dr. Martens posted lower profits despite hitting a record revenue milestone.

In addition to offering higher dividend payments, these stocks have the potential for more than 20% growth in their share prices.