Shares of British online food delivery company Deliveroo PLC (GB:ROO) gained 2.7% yesterday after Barclays analyst Andrew Ross upgraded the stock to Buy from Hold rating. Further, Ross raised the price target on ROO to 155.00p (14.6% upside) from 145.00p, ahead of its trading update scheduled for January 19.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

London-based Deliveroo is a food delivery company connecting consumers, riders, and restaurants. It earns revenue from commissions, customer fees, and food partner sign-up fees. ROO shares have gained over 46% in the past year.

Here’s Why Barclays Upgraded Deliveroo

Ross listed six factors for his newfound conviction in Deliveroo. The analyst believes that Deliveroo is poised to witness improved growth in 2024 with a mid-term margin upside in sight. Further, he believes that the possibilities for mergers and acquisitions could open up once Deliveroo’s founder Will Shu’s Class B shares expire in April.

Moreover, Ross is exploring the possibility of cash returns from the company in terms of dividends and/or share buybacks. Ross is also bullish about other factors, including Deliveroo’s consistent free cash flows and the chances of being included in the FTSE 250 index once the Class B shares expire.

In the first half of 2023, Deliveroo exceeded expectations and announced a share buyback. The company attributed the solid performance to the U.K. and Irish markets while lifting the full-year EBITDA (earnings before interest, tax, depreciation, and amortization) guidance.

What is the Forecast for Deliveroo Shares?

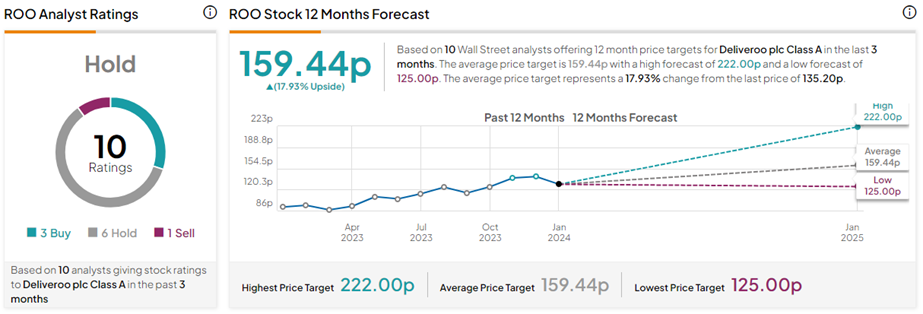

On TipRanks, ROO stock has a Hold consensus rating based on three Buys, six Holds, and one Sell rating. Analysts currently prefer to wait on the sidelines as the overall outlook for the online food delivery sector remains weak. Also, the Deliveroo plc Class A share price forecast of 159.44p implies 17.9% upside potential from current levels.