UK-based Deliveroo PLC’s (GB:ROO) shares surged by over 3% yesterday, followed by improved half-yearly earnings for 2023 and the announcement of a share buyback. The company described it as a “resilient performance,” driven by the UK and Irish markets, and also raised its guidance for the full year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

These results provided additional support to the share price, which had already registered a 40% increase over the past six months. Nonetheless, it has yet to attain its peak level from two years ago.

Deliveroo operates as a marketplace that delivers food and other essential items from its local partners to customers in the UK. The company now has a presence in 10 countries worldwide, catering to millions of customers.

Let’s take a look at some of the numbers.

H1 2023 Earnings

For the first half of 2023, the company’s revenue surpassed the significant milestone of £1 billion, which was 5% above last year’s level. The loss of £57.6 million during the period also came down from the £127.1 million reported in the first half of 2022. Despite this, adjusted earnings grew to £39.4 million, as compared to negative earnings of £51.6 million last year.

The company’s numbers mainly benefited from the higher gross transaction value (GTV) per order of £24.2, up by 10% from £22.1. This reflected the fact that customers are spending more money on every order. The total order volumes, however, were down by 6% to 145.2 million.

The company announced plans to allocate an additional £250 million in returns to its shareholders, including share buybacks and possible dividends. This decision is underpinned by the company’s robust cash position of £948 million as of June 30, 2023, demonstrating its strong belief in its capacity to generate further cash flow.

Talking about the outlook, Deliveroo raised its full-year EBITDA guidance to a range of £60 million to £80 million, a notable increase from the previous range of £20 million to £50 million.

What is the Forecast for Deliveroo Shares?

The company’s stock continues to trade considerably lower than its IPO price of 390p. The aftermath of the pandemic has contributed to reduced demand for online food delivery, while consumers face challenges from escalating living costs. However, the company’s recent performance has outperformed predictions, resulting in a surge in its share value.

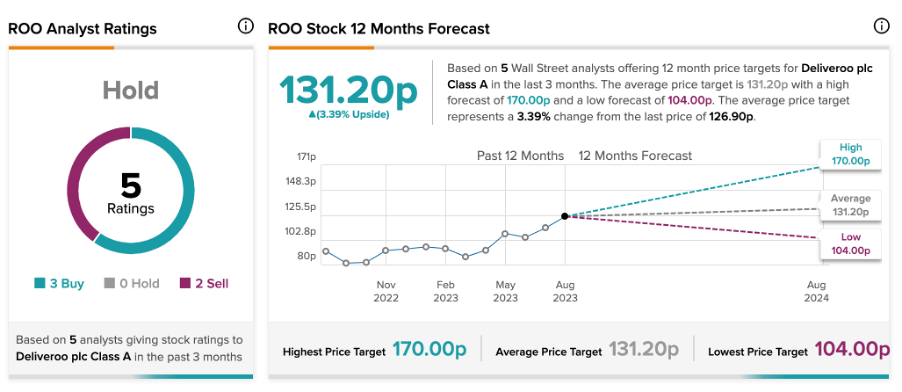

On TipRanks, ROO stock has a Hold rating based on three Buy and two Sell recommendations. The price target of 131.2p is 3.39% higher than the current trading levels.

It is important to note here that these ratings were assigned in the last month and could potentially see favorable changes from analysts, following the company’s robust earnings performance.