FTSE 100-listed CMC Markets PLC (GB:CMCX) saw its shares skyrocket over 25% in early morning trade on Monday after the company raised its net operating income guidance for Fiscal 2024, ending March 31, 2024. The company attributed the improved outlook to strong performance in the third quarter of Fiscal 2024. CMC is scheduled to provide the Fiscal 2024 pre-close update on April 9, 2024.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

London-based CMC Markets provides online and mobile trading services to both retail (D2C) and institutional (B2B) clients. CMC offers a range of services, including online trading in shares, spread betting, contracts, and foreign exchange. CMC shares have lost 37.1% in the past year.

More on CMC’s Upbeat Outlook

Following a positive Q3 performance, CMC now expects FY24 net operating income in the range of £290 million to £310 million compared to the prior estimate of £250 million to £280 million. The company’s solid Q3 performance was driven by better market conditions and increased contributions from the B2B and institutional clients.

For the first half of Fiscal 2024, CMC reported net operating income of £122.6 million, down 20% year-over-year due to the impact of lower client activity, an inflationary backdrop, and elevated interest rates. Following a challenging first half, the news of upbeat Q3 performance and revised full-year guidance was welcomed by investors, thus pushing CMCX shares higher today.

Is CMC Markets Stock a Buy?

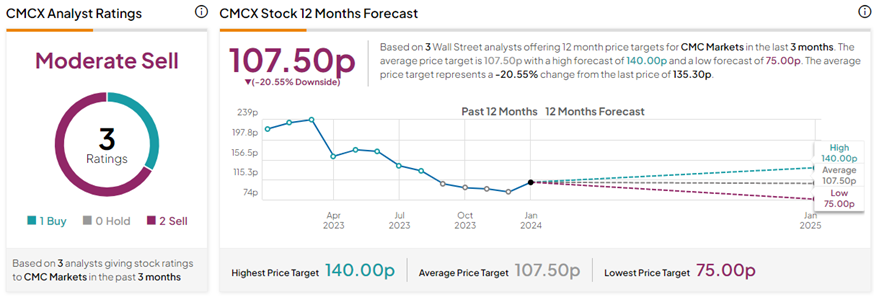

On TipRanks, CMCX stock has a Moderate Sell consensus rating based on one Buy versus two Sell ratings. The CMC Markets share price forecast of 107.50p implies 20.6% downside potential from current levels.