Shares of FTSE 250-listed Clarkson PLC (GB:CKN) are trading higher by 8.7% as of writing in reaction to the company’s improved Fiscal 2023 profit guidance. The profit forecast upgrade is based on the solid trading results in the final quarter of Fiscal 2023.

London-based Clarkson PLC is an integrated shipping service provider. It operates through the following segments: Broking, Financial, Support, and Research. Clarkson is considered one of the largest and well-established players in the shipbroking market. CKN shares have gained 7.2% in the past year.

Thanks to a strong quarter in its Broking division, Clarksons now expects Fiscal 2023 profit before tax to be at least £108 million, up 8% compared to £100.1 million in the previous year. For the first half of Fiscal 2023, Clarksons reported profit before tax of £52.2 million, reflecting an increase of 24% over the prior year period. Clarksons is set to report its full-year Fiscal 2023 results on March 4.

Is Clarkson a Good Stock to Buy?

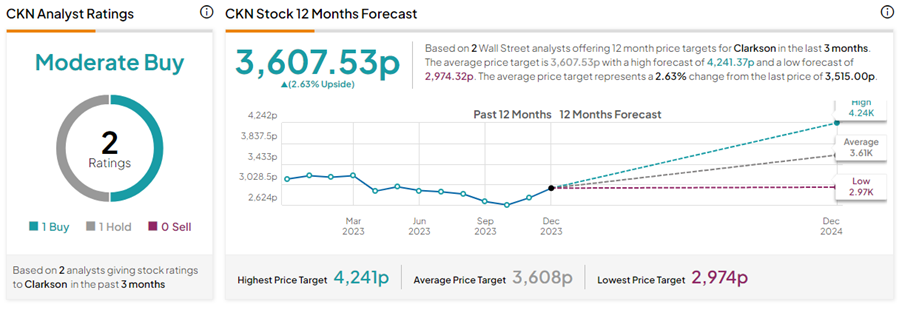

With one Buy versus one Hold rating, CKN stock has a Moderate Buy consensus rating on TipRanks. Also, the Clarkson PLC share price target of 3,607.53p implies 2.6% upside potential from current levels.