The China-based Xiaomi Corporation (HK:1810) broke its two-year revenue slump with its strong performance in Q3 2023 results. The company achieved year-over-year revenue growth, reaching ¥70.9 billion after a span of approximately two years. It posted a huge jump of over 180% in its net income of ¥6 billion in the third quarter, surpassing analysts’ forecast of ¥4.6 billion. Xiaomi’s leadership expressed confidence in effectively managing external pressures and market fluctuations, delivering growth in multiple businesses.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, the shares are experiencing a decline of approximately 6% at the time of writing.

Xiaomi is a Chinese technology company that provides an extensive range of consumer electronics and intelligent devices. The company is widely known for its innovative and cost-effective products, such as smartphones, smart home devices, wearables, etc.

Q3 Operational Review

In the third quarter of 2023, the company’s global smartphone shipments secured the third position globally, boasting a market share of 14.1% and reflecting a year-over-year increase of 0.5%. The total global smartphone shipments reached 41.8 million units, marking a 4.0% increase year-over-year and a substantial 27.0% growth quarter-over-quarter.

The company’s Internet of Things (IoT) business experienced noteworthy momentum with an 8.5% growth in revenue, reaching ¥20.7 billion compared to last year. This was driven by its valuable partnerships and growing user base.

Moving ahead, Xiaomi intends to introduce electric vehicles (EVs) in both domestic and international markets as an important component of its ecosystem approach. They are optimistic about seamlessly integrating their vehicles with their current mobile phones and other consumer electronics products.

What is the Prediction for Xiaomi Stock?

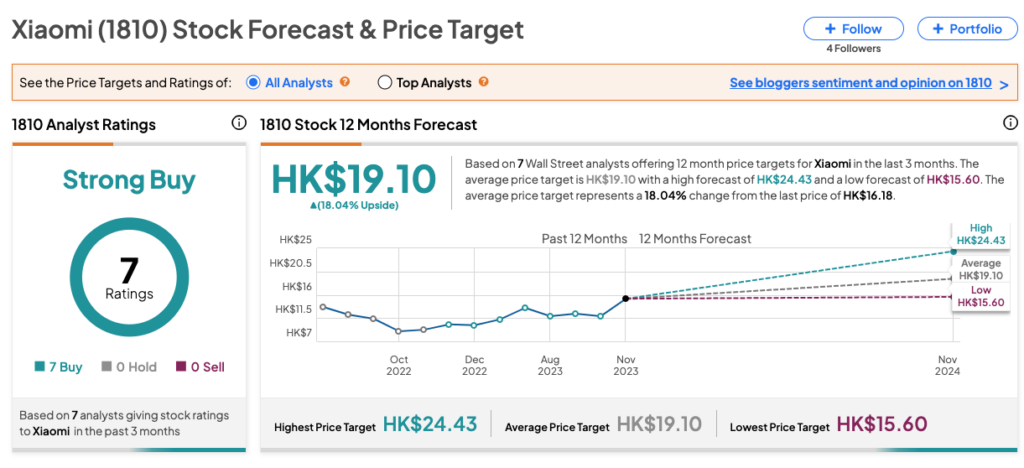

On TipRanks, 1810 stock has been assigned a Strong Buy rating based on all Buy recommendations from seven analysts. The Xiaomi share price target is HK$19.10, which is 18% above the current trading level.