Shares of CapitaLand Investment (SG:9CI) are down 3.9% at the time of writing after the SGX-listed company warned of a meaningful decline in its total profit after tax and minority interests (PATMI) for Fiscal 2023. On Friday, CLI announced that it expects to report mark-to-market losses on its portfolio of investment properties for Fiscal 2023. “Higher capitalization rates and weaker market sentiments” are the two factors directly impacting property prices in certain markets, CLI added.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

CapitaLand is a real estate investment management company boasting a portfolio of assets spanning 40 countries, with a strong presence in Asian markets.

CLI Under Pressure

CLI said its deal-making, fundraising, and overall operations are under pressure from rising interest rates and geopolitical issues. The company’s businesses in China, Australia, Europe, the U.K., and the U.S. are facing significant valuation pressures owing to macro challenges.

The good part is that these losses are simply on-paper losses, primarily based on fair value adjustments, meaning they are not realized losses. Moreover, CapitaLand ensured shareholders that its core operating earnings for Fiscal 2023 remain unscathed by the aforementioned issues and operating cash flows are stable.

In its Q3FY23 business update, CLI reported a 3% year-over-year decline in revenue and a 42% fall in total transactions for the first nine months of 2023 owing to similar reasons. CLI is scheduled to report its full-year Fiscal 2023 results in February 2024.

What is the Price Target for SGX 9CI?

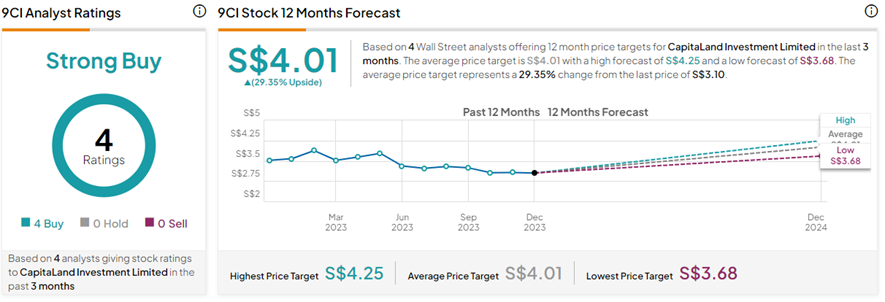

On TipRanks, the CapitaLand Investment share price target of S$4.01 implies 29.4% upside potential from current levels. The 9CI stock commands a Strong Buy consensus rating based on four unanimous buys received during the last three months. Year-to-date, 9CI shares have lost 14.1%.