Shares of CAC 40-listed bank Societe Generale, or SocGen (FR:GLE) declined by 12% on Monday as investors were unimpressed with the new strategic plan announced by CEO Slawomir Krupa. According to a three-year plan, Krupa aims to enhance the bank’s capital reserves while maintaining its profitability levels and reducing costs. The CEO also established new goals for the bank to revive its growth story following a period of underwhelming performance.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This marks Krupa’s first strategic plan for the bank following his appointment as SocGen’s CEO in May 2023.

Investors expressed their dissatisfaction with the new goals, which was evident in the company’s share price decline. The fall in the share price marked the largest daily drop since March 2023, making the stock the worst performer on the CAC 40 index on Monday. The shares continued their downward trajectory and traded down by 1.3% at the time of writing on Tuesday.

Societe Generale is a prominent European financial institution, catering to approximately 25 million customers. The group offers a wide range of services, including banking, insurance, investment banking, and various other financial services, to both retail and corporate clients.

Highlights of the Strategic Plan

The bank is targeting modest revenue growth, averaging between zero and 2% from 2022 to 2026, lower than its previous objective of achieving at least 3% growth during the 2021-2025 period. Additionally, the bank has set a new target for a return on tangible equity (ROTE) ranging between 9% and 10% by 2026, compared with its earlier goal of 10% by 2025.

Regarding shareholders’ return, the bank has adjusted its profit distribution plans, stating that it will now allocate between 40% and 50% of earnings to investors. This reflects a decrease from the 90% distribution rate observed last year.

Is Societe Generale a Buy?

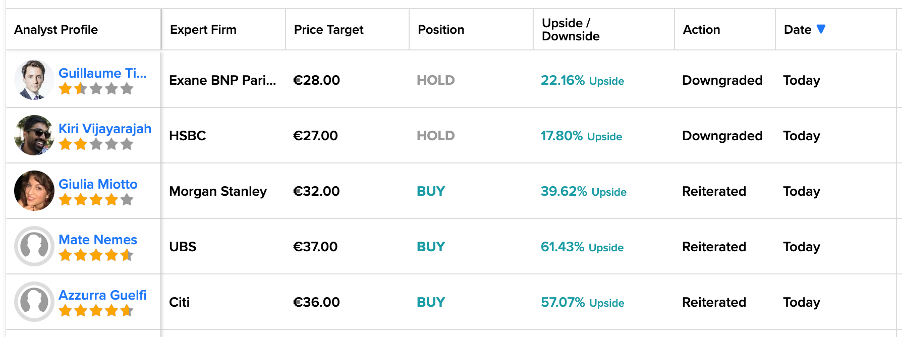

Analysts had a mixed reaction to the update and also expressed their concern about the lack of more details in the plan. Today, analysts Guillaume Tiberghien from Exane BNP Paribas and Kiri Vijayarajah from HSBC downgraded their ratings for GLE stock from Buy to Hold.

On the other hand, analysts from Morgan Stanley, UBS, and Citi expressed satisfaction with the plan and maintained their Buy ratings on the stock. Analyst Azzurra Guelfi from Citi said, “This is a credible plan that can start the stock’s re-rating.” Guelfi has a price target of €36 on the stock and predicts a growth of 57% in the share price.

Overall, on TipRanks, GLE stock has received a Moderate Buy rating based on five Buy and six Hold recommendations. The Societe Generale share price forecast of €33.36 implies an upside potential of 46% on the current trading price.