The UK-based Burberry Group PLC’s (GB:BRBY) share price declined on Wednesday after analyst Rogerio Fujimori from Stifel Nicolaus downgraded his rating from Buy to Hold. Fujimori also reduced his price target on BRBY stock from 1,950p to 1,550p, now predicting an upside of 13.2%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Burberry share price is trading down by 2.21% today as of writing. The stock lost over 30% of its value in 2023 amid deteriorating trends in the luxury fashion sector.

Burberry Group is an international luxury brand that designs and sells clothing, footwear, and accessories in diverse markets.

Factors Behind Stifel’s Downgrade

Stifel decreased its earnings estimates for the company, which led to the rating downgrade. It foresees a 12% decline in Burberry’s EBIT (earnings before interest and taxes) for FY25, which now stands 5% below the overall market consensus. This downward revision is mainly triggered by lower growth expectations for the second half of FY24 and FY25, coupled with the expected adverse impact on profit margins.

Fujimori believes the current downfall in the luxury sector will pose more challenges in the “ongoing transformation” of the company. This could further make it difficult for the company to defeat its competition. He also added that it is too early to comment on the leadership of Daniel Lee, the company’s chief creative officer.

Fujimori recommends investors to be more patient, as he expects the earnings downturn to continue. He called Burberry “a cheap stock that lacks the catalysts for a re-rating.”

What is the Forecast for Burberry?

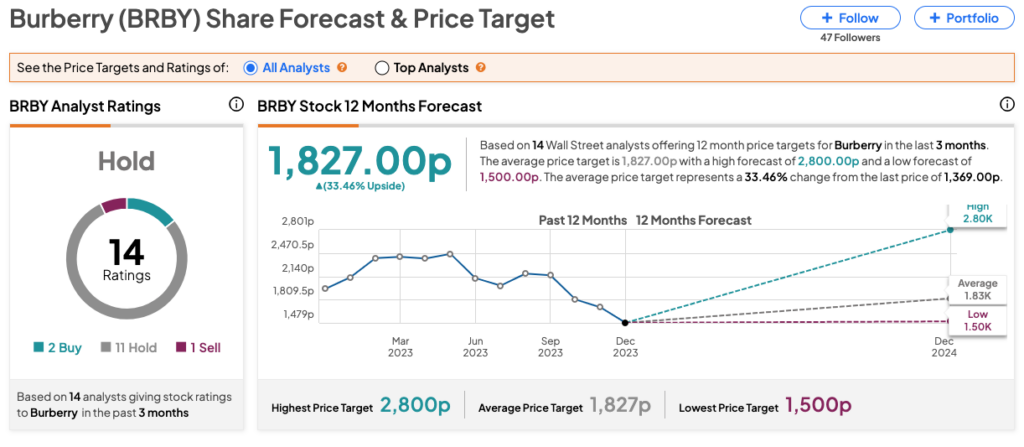

On TipRanks, BRBY stock has received a Hold rating, backed by 14 recommendations from analysts. It includes two Buys, 11 Holds, and one Sell rating. The average share price target is 1,827p, which is 33.5% higher than the current trading level.