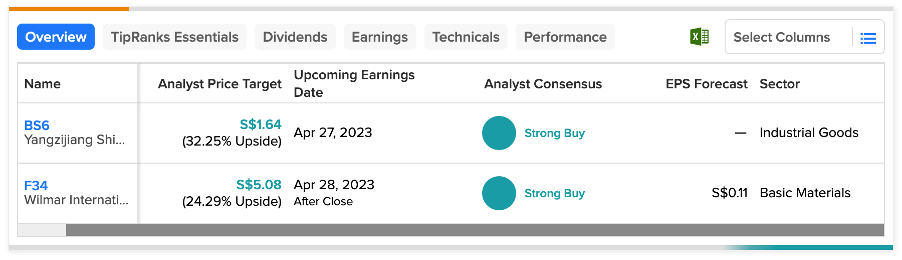

SGX-listed companies Yangzijiang Shipbuilding (SG:BS6) and Wilmar International (SG:F34) will release their Q1 earnings for 2023 this week. Ahead of the results, analysts are bullish on these stocks with Strong Buy ratings.

With the TipRanks Earnings Calendar, investors can monitor the scheduled earnings dates of companies across seven markets. By utilizing this resource, investors can analyze the projected EPS and make comparisons with the previous year’s figures.

Let’s examine these companies more closely.

Yangzijiang Shipbuilding Group

Yangzijiang Shipbuilding is a group company that provides manufacturing and engineering services in the marine sector. The company also offers logistics, leasing, and real estate services.

The company will announce its first-quarter earnings for 2023 on April 27.

Yesterday, the company announced new order wins worth $1.18 billion so far in 2023. The order book value YTD has reached a record of $11 billion. With the new order wins, the company has already achieved almost 40% of its order target of $3 billion for 2023.

Considering its strong order momentum, analysts are bullish on the results and the share price. Yesterday, analyst Siew Khee Lim from CGS-CIMB reiterated her Buy rating on the stock and expects a 33% growth in the share price.

Lim is bullish on the results based on higher expected margins in the upcoming results and order growth, which provides clarity for revenues till 2026.

Yangzijiang Shipbuilding Price Target

TipRanks rates BS6 stock as a Strong Buy based on all five Buy recommendations. The average price target of S$1.65 implies an upside of 33% from the current level.

Wilmar International Limited

Wilmar is a Singapore-based food processing group company operating through 300 subsidiaries. The company’s businesses include palm oil plantations, sugar milling, shipping, and many more.

Wilmar will announce its Q1 2023 earnings on April 28. The consensus EPS forecast by analysts on TipRanks is S$0.11 per share, higher than the EPS of S$0.06 per share for the same quarter last year. Analysts are bullish on the results and see no impact from Adani Wilmar Limited’s controversy with Hindenburg Research.

8 days ago, analyst Leow Huey Chuen from UOB Kay Hian maintained his Buy rating on the stock at a price target of S$1.66. The price indicates a growth of 34% from the current price level.

DBS analyst William Simadiputra has the highest price target on the stock, which implies an upside of more than 60% in the share price. He commented, “We believe Wilmar will be able to maintain its earnings performance amid commodity price volatility as Wilmar’s products have resilient demand.”

What is the Price Target for Wilmar?

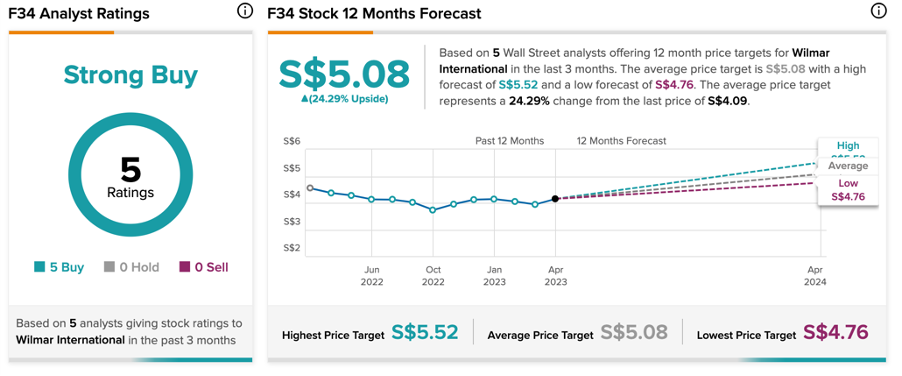

According to TipRanks, F34 stock has a Strong Buy rating with all five Buy recommendations.

The average price target is S$5.08, which is 24.3% higher than the current price level. The target price ranges from a low of S$4.76 to a high of S$5.52.

Conclusion

Prior to their earnings announcements, analysts maintained their optimistic outlook on these companies and reaffirmed their Buy recommendations.