British Companies HSBC Holdings (GB:HSBA) and Diageo PLC (GB:DGE) posted strong numbers yesterday in their earnings reports. HSBC reported its second-quarter earnings, while beverage giant Diageo announced full-year results for 2023.

Analysts have expressed a more bullish take on HSBC stock with a Moderate Buy rating. Whereas DGE stock has a mixed opinion from analysts with a Hold rating.

The TipRanks Earnings Calendar offers users a perfect way to identify companies that have recently reported their earnings and upcoming announcements. This tool is available in nine different markets and can assist investors in selecting the right stocks for further research.

Let’s dig deeper into the numbers.

HSBC Interim Results 2023

In its first-half earnings, HSBC’s net profit surged to $18.1 billion, more than doubling the figure from the same period a year earlier, which was $9 billion. The profit before tax also grew by a whopping 147% to $21.7 billion from $8.78 billion in 2022. The higher interest rates in the U.S. and UK markets were the main drivers behind the bank’s encouraging performance. The net interest income in the first six months was $18.3 billion, up by 36% on a year-over-year basis.

Talking about shareholders’ returns, the bank announced an interim dividend of $0.10 per share along with an additional buyback of $2 billion.

Backed by such strong numbers, HSBC has raised its significant performance target of return on tangible equity from 9.9% to 12% in the near term.

Is HSBC a Good Stock to Buy Now?

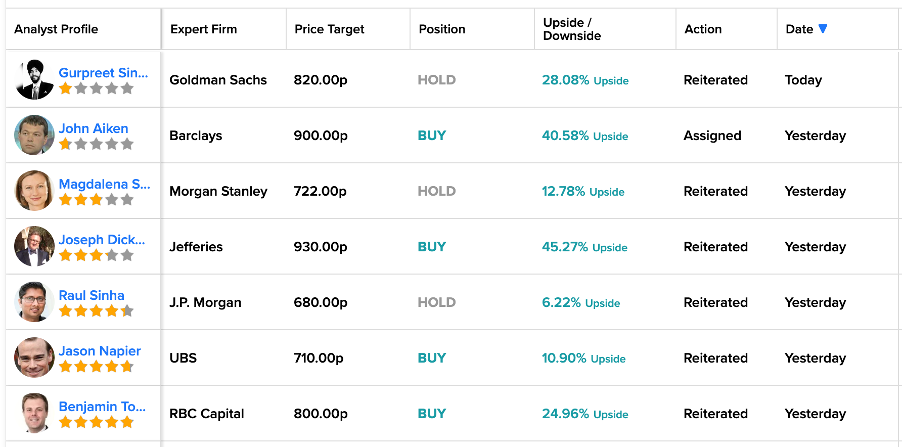

Post-results, analysts have confirmed their ratings, expressing their optimism about the share price in the future. Analysts have welcomed the overall strong numbers in the results, a positive outlook, and attractive returns for its shareholders.

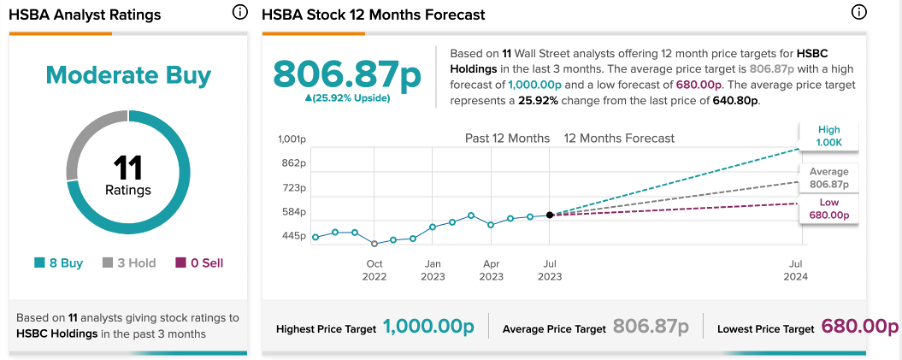

According to TipRanks’ analyst consensus, HSBA stock has a Moderate Buy rating. The stock has eight Buy and three Hold recommendations.

The average share price forecast is 806.87p, which is almost 26% higher than the current price level.

Diageo Full-Year Results 2023

UK-based beverage company Diageo posted a 10.7% growth in its net sales of £17.1 billion in its annual results for 2023. Among its segments, sales were mainly driven by its Scotch and Tequila segments, which grew by 12% and 19%, respectively. The company’s organic sales volume was down by 0.8%; however, it was offset by its superior pricing power.

The pre-tax profits increased by 8% to £4.7 billion. This encouraged the company to continue its progressive dividend policy. The full-year dividend was increased by 5% to 80p per share, including the final dividend of 49.17p declared in the results. Overall, the results were mostly in line with analysts’ expectations, and the company reaffirmed its 2023-2025 guidance, projecting organic net sales growth of 5% to 7% annually.

What is the Forecast for Diageo Shares?

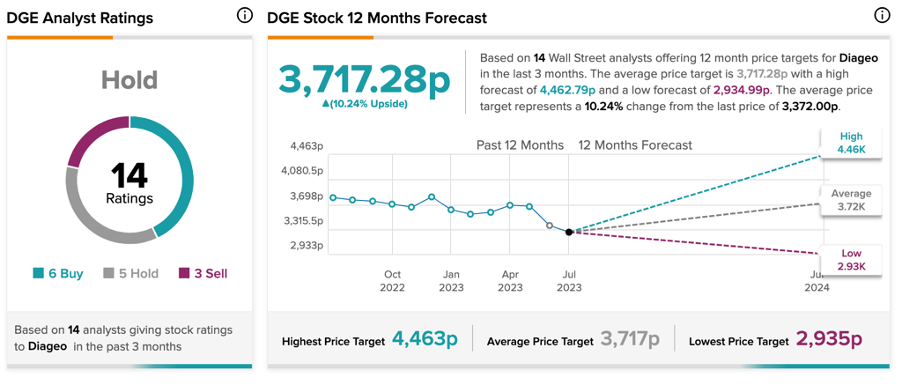

DGE stock has a Hold rating on TipRanks, based on six Buy, five Hold, and three Sell recommendations.

The average target price is 3,717.3p, which implies an upside of 10.2% on the current trading price.