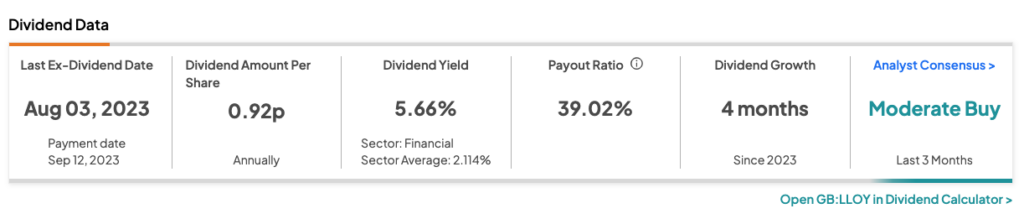

The FTSE 100-listed Lloyds Banking Group PLC (GB:LLOY) presents investors with a chance to boost their income portfolio through substantial dividends. With a noteworthy dividend yield of 5.66%, surpassing the industry average, Lloyds is an attractive choice for income investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

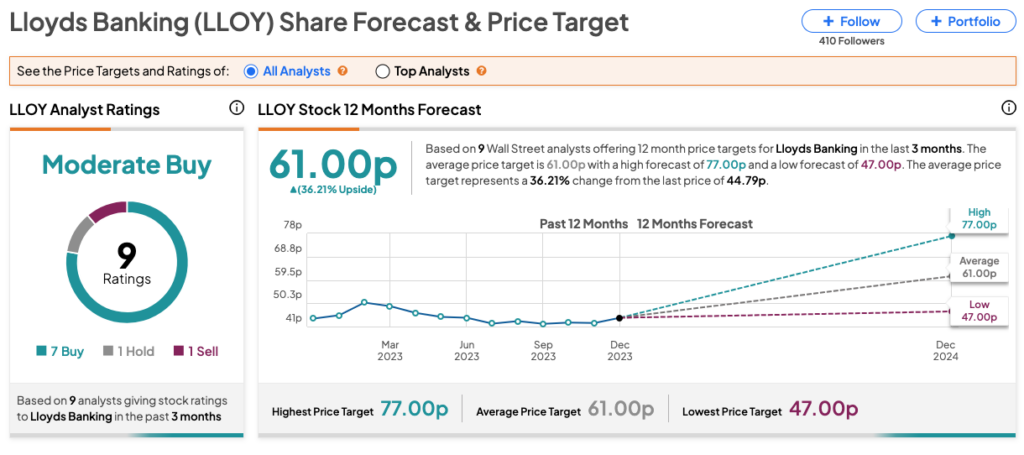

As one of the oldest banks in the UK market, Lloyds’ stock is always closely monitored on the FTSE 100 index. In terms of its share price growth, the stock offers a decent upside of around 36% and has been rated as a Moderate Buy by analysts.

TipRanks provides a range of tools to assist users in identifying suitable dividend stocks that align with their preferences. Here, we used the TipRanks Top Dividend Shares tool for the UK market to identify Lloyds’ stock. This tool simplifies the stock selection process, making it more efficient for users seeking specific dividend investments.

Lloyds’ Dividend Forecast

Lloyds raised its interim dividend for FY23 to 0.92p per share, reflecting a 15% increase compared to the same period in 2022. The most recent dividend was paid in September 2023. Despite challenges like increased competition, a rise in bad loan provisions, shrinking lending margins, and rising operational costs, the bank is committed to delivering higher shareholder returns.

The total dividend for the fiscal year 2022 was 2.4p per share. According to analysts’ consensus, dividends are projected to increase to 2.8p in 2023, followed by an anticipated growth to 3.2p and 3.6p in 2024 and 2025, respectively.

In its Q3 2023 trading update, the bank posted a pre-tax profit of £1.9 billion, surpassing analysts’ expectations of £1.8 billion. Lloyds has also maintained its full-year guidance. Additionally, Lloyds has a robust balance sheet that it can leverage to meet the anticipated dividend. Despite a 40 basis point decline in its CET1 capital ratio to 14.6% by September, the key metric remains one of the highest among the UK’s listed banks.

What is the Future for Lloyds Shares?

During a high interest rate backdrop, Lloyds’s stock gained good momentum, with a 35% return in the last three years. However, year-to-date, the shares have trended downward, with a marginal loss of 0.36%. Considering the UK economic downturn, higher interest rates, and energy costs, 2024 looks to be a tough year for Lloyds and other banks.

According to TipRanks’ analyst consensus, LLOY stock has a Moderate Buy rating based on a total of nine recommendations, including seven Buys, one Hold, and one Sell. The Lloyds share price prediction is 61p, which indicates an upside potential of 36.2% in the share price.