The share price of the UK-based Boohoo Group PLC (GB:DARK) fell by over 10% after the company trimmed its annual revenue outlook in its half-yearly earnings report for FY24. The company posted a 17% decline in its revenues due to a slower volume recovery amid reduced demand from customers.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the announcement, the Boohoo share price experienced a 10% decline in early trading, reaching its lowest level since 2015. In the last six months, the stock has experienced a 45% decline, reflecting the ongoing challenges of declining demand and rising costs.

Boohoo Group PC is a British online fashion retailer established in 2006. The company specializes in offering a wide range of clothing, accessories, and cosmetics through its online platform, targeting customers aged between 16 and 40 years.

Weak Numbers and a Weaker Outlook

The Group posted a revenue of £729 million for the six months that ended on August 31, 2023, which was 17% lower than the previous year. Among its regions, revenue from the UK market experienced a 19% decline, while international markets saw a reduction of 15%. The numbers show the impact of a tougher economic environment on consumer demand.

The gross profit also decreased by 16% to £389 million, as compared to £464 million in the same period last year. However, the gross margin saw an increase of 90 bps to 53.4% during this period. The adjusted EBITDA came at £31 million, down by 12% from the last year. On the plus side, the adjusted EBITDA margin improved by 30 bps to 4.3%, driven by cost control measures and better inventory management.

In terms of outlook, revenues for the full fiscal year ending in February 2024 are now projected to decline by 12% to 17%, up from the expected decline of 5% stated by the company in May. EBITDA is now expected to be in the range of £58 million to £70 million, marking a revision from the previous guidance of £69 million to £78 million.

What is the Forecast for Boohoo Shares?

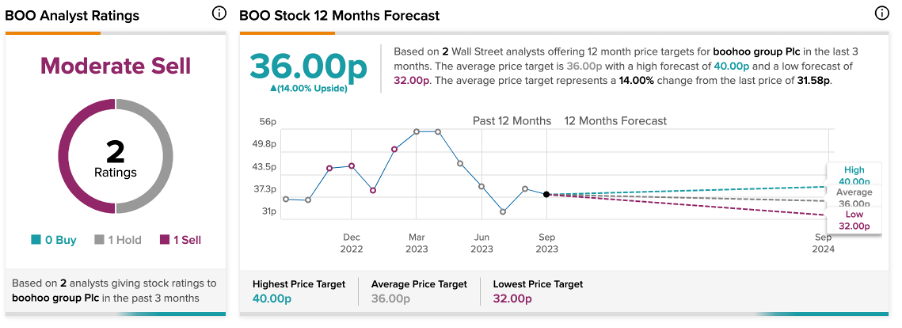

Today, Jefferies analyst Andrew Wade reiterated his Buy rating on the stock, predicting a growth rate of more than 135%. Wade believes that despite the dull results, the ongoing investments and operational advancements within the business will place it in a favorable position for recovery once demand conditions improve.

As per the consensus among analysts on TipRanks, BOO stock has been assigned a Moderate Sell rating.