German automaker BMW AG’s (DE:BMW) CFO Walter Mertl says that auto sales of internal combustion engine (ICE) vehicles already reached a “tipping point” last year and are expected to start a descent soon. At the same time, electric vehicles (EVs) are the way to go forward, as more countries are moving toward decarbonization goals with tighter frameworks and deadlines.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

DAX-40 listed BMW is one of the largest auto manufacturers in the world. It manufactures luxury vehicles and motorcycles. BMW shares have gained 4% in the past year.

Here’s More on BMW CFO’s Thoughts

At a roundtable call with journalists, Mertl said that BMW’s ICE or combustion engine vehicle sales peaked last year and have plateaued now. He sees EVs driving the overall sales growth, as the deadline for most countries’ non-carbon goals is set for the middle of the decade.

In 2023, BMW’s EVs contributed about 15% toward total group sales. The company aims to boost this figure to 33% by 2026, backed by the launch of six new EV models of the “Neue Klasse” range. Having said that, Mertl warned that the margins from EVs and ICE autos will not be comparable before at least 2026. Mertl added that BMW is on track to reaching its goal of selling 3 million autos by 2030, with an 8% to 10% margin range in the automotive segment.

Companies need to shell out more to introduce new battery technology in the latest EV models, which is weighing on their margins. Moreover, EV companies are engaged in a heated price war, offering huge discounts on EV sales. Also, the pace for EV demand is not picking up as much as expected, putting a dent in companies’ EV ambitions. These challenges explain Mertl’s cautious outlook regarding BMW’s EV margins.

What is the Price Prediction for BMW?

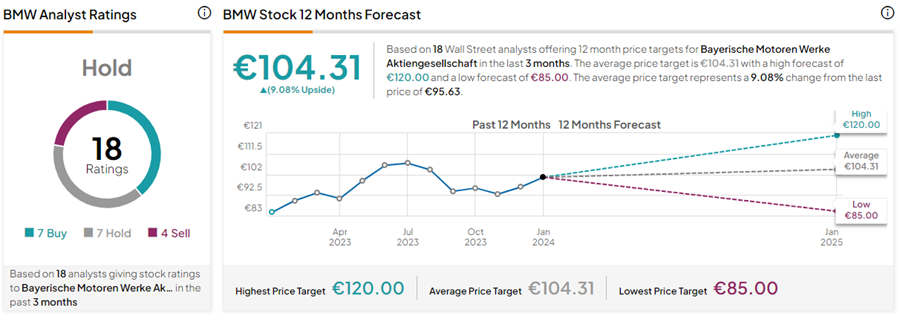

Last week, UBS analyst Patrick Hummel reiterated a Hold rating on BMW with a price target of €100 (4.6% upside potential).

Overall, BMW stock has a Hold consensus rating on TipRanks backed by seven Buys, seven Holds, and four Sell ratings. The BMW AG share price forecast of €104.31 implies 9.1% upside potential from current levels.