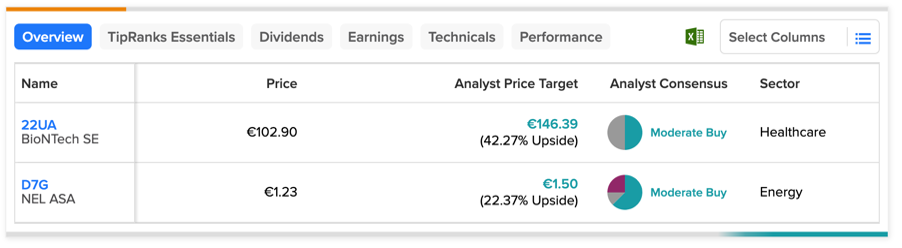

German companies BioNTech SE (DE:22UA) and NEL ASA (DE:D7G) have received Buy ratings from analysts. BioNTech stock presents a notable share price growth opportunity of over 40%, whereas NEL ASA demonstrates a more modest upside potential of 22%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at some details.

BioNTech SE

BioNTech SE is a renowned biotechnology firm specializing in the advancement of immunotherapies to combat cancer and infectious diseases.

Following a successful period of distributing its COVID-19 vaccine, Comirnaty, the sales and shares of the company are now experiencing a decline. YTD, the shares have been trading down by 27%. The company witnessed a fall in its revenues from €6.37 billion in Q1 2022 to €1.27 billion in Q1 2023. BioNTech anticipates generating approximately $5 billion in revenue from Comirnaty this year. With the potential successful launch of another drug, the company possesses the financial strength to effectively market it.

Four days ago, William Maughan from Canaccord Genuity reiterated his Buy rating on the stock, forecasting an 80.7% hike in the share price.

Is BioNTech a Good Stock to Buy?

On TipRanks, 22UA stock has a Moderate Buy rating with a total of 14 recommendations, including seven Buy and seven Hold.

The average stock forecast is €146.4, which has an upside potential of 42%. The target price has a high forecast of €186 and a low forecast of €99.8.

Nel ASA

Nel is a global company, offering comprehensive solutions for the renewable production, storage, and distribution of hydrogen.

The company is a leading name in fuel cell stocks, and analysts believe in its capacity to achieve superior performance within a more favorable market landscape for green hydrogen. In its Q1 2023 earnings, revenues grew by 68% to NOK359 million. Moreover, the order intake jumped by more than 100% during the quarter.

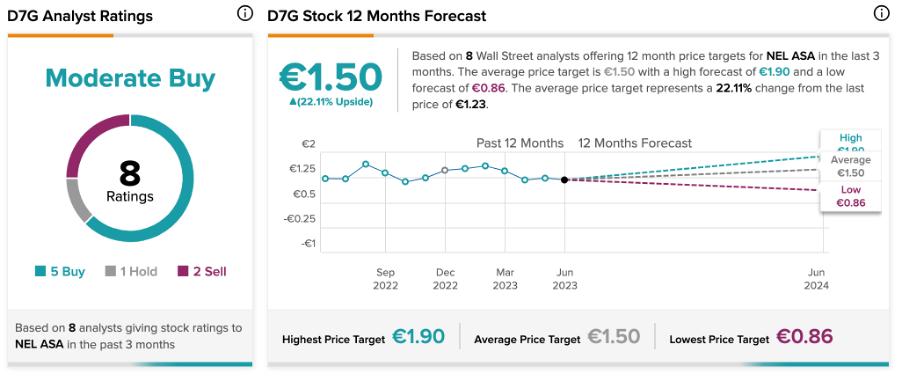

On TipRanks, analysts hold mixed opinions about the stock. Four days ago, Thomas Morde from Bryan Garnier & Co. downgraded his rating from Hold to Sell on the stock. He predicts a 30% downside in the share price.

On the plus side, Berenberg Bank’s analyst James Carmichael holds a bullish view on the stock, forecasting a 32% growth in the share price.

What is the Price Prediction for Nel Asa?

According to TipRanks, D7G stock has a Moderate Buy rating based on five Buy, one Hold, and two Sell recommendations.

The average target price is €1.5, which represents a 22% change from the current price level.

Conclusion

Analysts maintain an optimistic outlook on these two stocks and recommend purchasing them. In terms of potential share price growth, BioNTech stock presents a higher growth rate of approximately 42%.