German multinational drug maker Bayer AG (DE:BAYN) intends to continue its U.S. expansion plans despite facing hiccups in its drug trials, the company’s pharmaceuticals head Stefan Oelrich told Reuters at the JPMorgan health conference in San Francisco. Its blood thinner drug candidate asundexian failed to show superior quality over rival drugs, Bayer announced in November. Also, the U.S. Food and Drug Administration (FDA) rejected the application for the new use of asundexian.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Bayer is a pharmaceutical and biotechnology with products spanning pharmaceuticals, consumer healthcare products, agricultural chemicals, seeds, and biotechnology products. The company is one of the largest players in the global pharma market and a part of the STOXX 50 index. BAYN shares have lost 29.2% in the past year.

More About Bayer’s U.S. Ambitions

Bayer is steadfast in its commitment to serving the needs of patients in the U.S. The company intends to continue investing heavily in research and development in the U.S. and sell drugs in the country directly instead of partnering with domestic companies. In March 2023, Bayer said that it planned to spend $1 billion during the year toward drug R&D expenses in the U.S. as part of its goal to double the sales from this key market by the end of the decade.

Oelrich said on Monday that he expects the second trial of its anticoagulant asundexian to be successful. Further, Oelrich believes that the scope for the commercial success of its cardiovascular and menopause symptom relief treatment drugs in the U.S. is massive. Thus, the company remains committed to expanding in the U.S. as the rewards for innovation are greater than in Europe.

In both Fiscal 2022 and in the nine months ending September 30, 2023, 35% of Bayer’s total sales came from North America. This reflects significant opportunities for the company to increase its sales proportion from the region. Bayer is scheduled to report its fourth quarter and full-year Fiscal 2023 results on March 5, 2024. Analysts expect Bayer to report earnings of €1.34 per share on sales of €11.76 billion.

What is Bayer’s Stock Price Target?

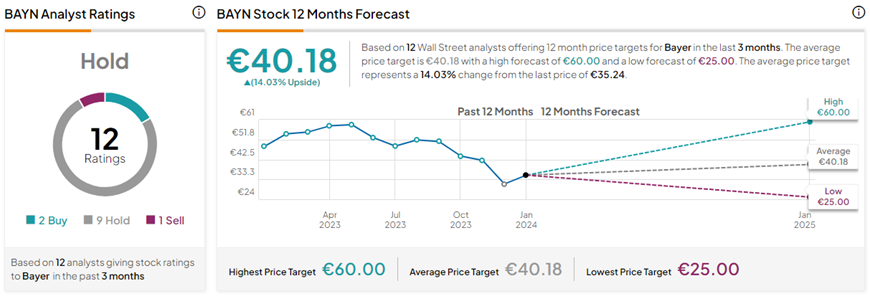

Yesterday, three analysts from well-known research firms maintained their Hold rating on BAYN stock and kept their price targets unchanged.

Analysts prefer remaining on the sidelines on BAYN stock at the moment. BAYN stock has a Hold consensus rating based on two Buys, nine Holds, and one Sell rating. On TipRanks, Bayer AG share price target of €40.18 implies 14% upside potential from current levels.