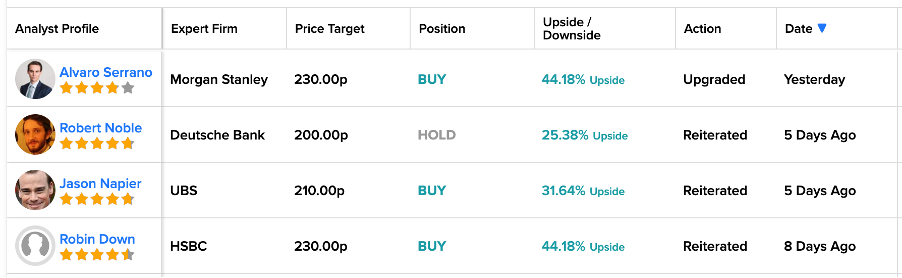

The FTSE 100-listed Barclays PLC’s (GB:BARC) share price gained over 3% yesterday after it received a rating upgrade from Morgan Stanley. Analyst Alvaro Serrano and his team upgraded their rating on the stock from Hold to Buy, predicting a growth rate of 44% in the share price. Morgan Stanley’s Buy recommendation for the stock was made after a gap of approximately six years. Prior to this, Morgan Stanley downgraded the rating on Barclays’ stock in 2018.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The rating upgrade made investors happy, resulting in a 3.73% increase in the stock’s value on Monday. Notably, Barclays stood out among the top performers on the FSTE 100 index yesterday after the broker upgrade. Over the last six months, the stock has gained around 14% in trading.

Barclays is among the top four leading banks in the UK, serving around 48 million customers globally. The bank provides a complete range of services, including retail and corporate banking, wealth management, investment banking, etc.

Upgraded to Buy

The upgrade from Morgan Stanley is attributed to Barclays’ strong consumer strategies, profitable deals, and impressive growth in the credit card segment. Serrano believes the bank’s credit card growth in the U.S. is “under-appreciated.” He added that the bank is steadily expanding its presence in the credit card business, a development that is expected to enhance its profitability over its competitors. Additionally, the growth initiatives in its CC&P (consumer, credit, and payments) segment could drive better capital efficiency, leading to increased payouts.

Serrano has also upgraded his 2024-25 revenue estimates in CC&P for the bank to be 8% above the consensus.

Serrano is a four-star-rated analyst on TipRanks and is ranked #2,158 out of 8,560 analysts in the TipRanks database. He mainly covers banking stocks from the U.S., UK, Spain, and Italy. The TipRanks Star Ranking system evaluates and ranks financial experts by analyzing their performance across three critical metrics: success rate, average return, and statistical significance.

Five days ago, Robert Noble from Deutsche Bank confirmed his Hold rating on the stock, forecasting a 25% increase in the share price. On the same day, Jason Napier from UBS also reiterated his Buy rating with a prediction of more than 30% growth in the shares.

Is Barclays a Good Share to Buy?

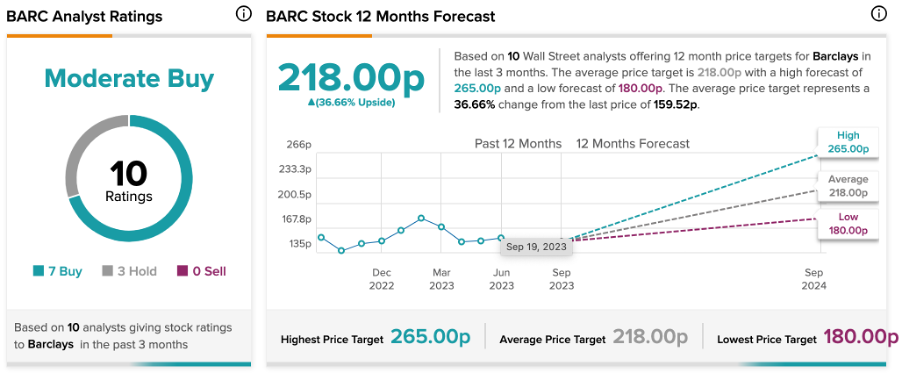

BARC stock has received a Moderate Buy rating on TipRanks, backed by seven Buy and three Hold ratings. The Barclays share price forecast is 218p, which is 37% higher than the current trading level.