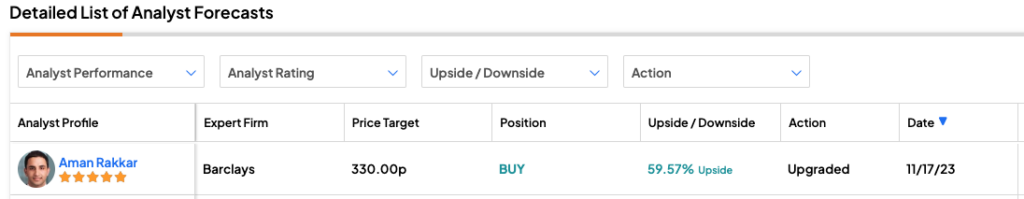

Barclays analysts have upgraded their assessment of UK banking stocks and picked NatWest Group (GB:NWG) as its preferred choice, replacing Lloyds Banking Group PLC (GB:LLOY). Analyst Aman Rakkar and his team from Barclays upgraded their rating on NWG stock from Hold to Buy, citing their anticipation of a substantial profit rebound.

He increased his price target from 315p to 330p, which implies an upside of almost 60% from today’s current trading price of 206.5p.

Barclays stated that it has upgraded its rating on NatWest due to observed indications of a decline in deposit migration, now positioning it as the most well-equipped to navigate term-funding risks. It also forecasts net interest margin (NIM) and earnings to be ahead of consensus, along with a double-digit RoTE in the medium term.

Barclays also remains positive on Lloyds but sees better growth prospects in NIM at NatWest, supported by a “best-in-class structural hedge yield.” Rakkar has a Buy rating on Lloyds stock at a price target of 67p, implying a 55% gain in the share price.

NatWest Q3 2023 Earnings Snapshot

In October, the bank reported a pre-tax profit of £1.3 billion in the third quarter, marking an increase from £1.1 billion in the previous year. NatWest’s total income witnessed a 3% rise in Q3 on a year-over-year basis. In the past nine months, total income saw a substantial 17% increase, reaching £10.9 billion.

The NIM experienced a decline of 19 basis points compared to the preceding quarter, settling at 2.94%. This change was attributed to a customer shift towards interest-bearing accounts, which had an impact on the bank’s margins.

Is NatWest a Good Share to Buy?

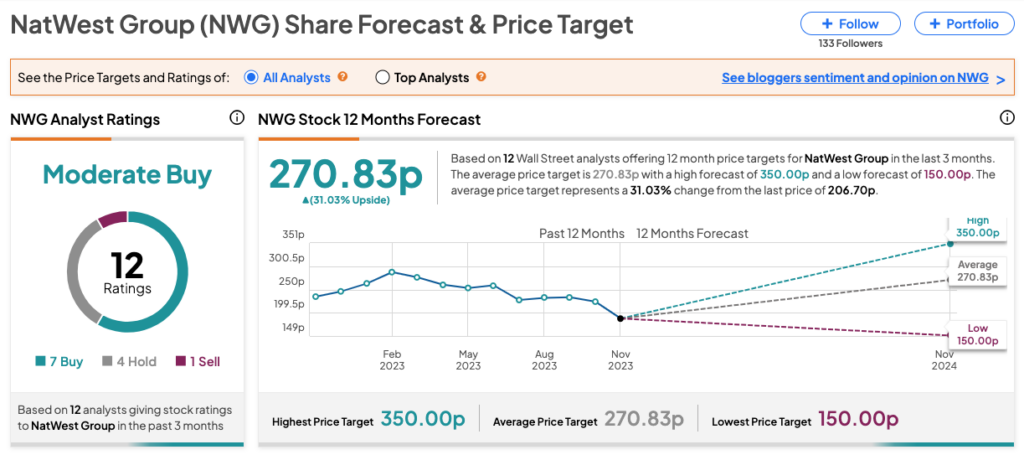

According to TipRanks, the NWG stock has a Moderate Buy rating, which is based on a total of 12 recommendations. This includes seven Buy, four Hold, and one Sell recommendation. The NatWest share price forecast is 270.83p, implying a gain of 31% from the current trading levels.