In major news on Australian stocks, Woodside Energy Group (AU:WDS) reported a decline in its revenues for the first quarter of FY24, mainly due to lower oil and LNG prices and a fall in volumes. The company’s Q1 revenue declined 12% to $2.97 billion, compared to the previous quarter. Additionally, the company is bracing for a potentially contentious vote by its shareholders on its Climate Transition Action Plan (CTAP) at the upcoming 2024 annual meeting, slated for April 24. WDS stock lost 0.17% in today’s trading session.

Woodside Energy is an oil and gas exploration company with a diversified portfolio of quality assets. The company has projects in Australia, Mexico, and Trinidad and Tobago.

Insights from Woodside’s Q1 Report

Woodside’s production during the first quarter decreased by 7% to 44.9 million boe (barrels of oil) as compared to the last quarter of 2023. The company kept its full-year guidance unchanged at 185-195 million boe.

The average released price was down by 5% to $63/boe from $67/boe in the prior quarter. The price declined by 25% in comparison to the same quarter last year.

Woodside’s Climate Plan Under Scrutiny

Woodside released its climate plan and report in February and further summarised its approach in its 2023 annual report. Later in March, the company conducted an investor briefing, outlining its approach to climate change and energy transition. As per this plan, Woodside aims to achieve net zero emissions by 2050 and also introduce a new Scope 3 target. The company’s existing targets include allocating $5 billion towards alternative energy initiatives by 2030.

Woodside is under the spotlight of environmental activists as well as certain shareholders who are opposing this plan. They advocate the implementation of stricter and more transparent measures.

Is Woodside a Good Buy Now?

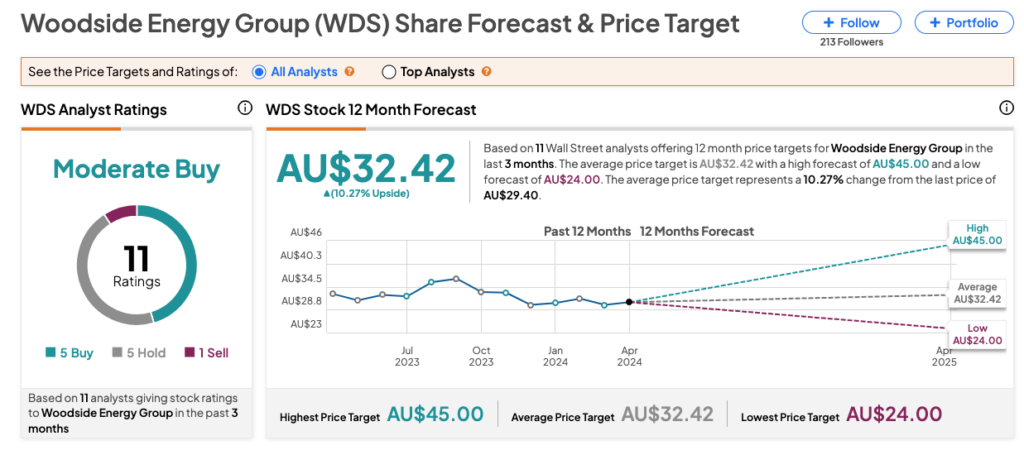

WDS stock received a Moderate Buy rating on TipRanks, backed by five Buys, five Holds, and one Sell recommendation. The Woodside share price forecast is AU$32.42, implying a change of 10.3% from the current price level.