In key news for Australian stocks, energy major Santos Ltd (AU:STO) said it is seeking strategic options after reporting a 42% decline in underlying profit for Fiscal 2023. In early February, Santos and rival Woodside Energy Group (AU:WDS) ended their mega-merger talks as both sides could not agree on the deal terms. STO stock fell 2% in early trade following the news this morning.

Santos’ Dismal FY23 Results

For FY23, Santos’ sales revenue collapsed 24% to $5.89 billion, while net profit fell 33% to $1.42 billion. Also, free cash flow for the full year fell 42% to $2.13 billion. The oil and gas company said that falling commodity prices and persistent inflation resulted in a lower profit.

To make things worse, Santos said it would continue suspending its share buyback plans and instead announced lucrative dividend payouts. The company’s board declared a final dividend of $0.175 per share, making the total dividend of $0.262 per share, up 15.4% compared to 2022.

CEO Kevin Gallagher said that Santos continues to pursue strategic alternatives for its LNG assets and ways to derive greater shareholder value. Gallagher also noted that the work at the Barossa gas project had finally resumed work last month after months of legal issues. The delivery of the first gas from the project is expected in 18 months.

Santos is also depending on its carbon capture and storage (CCS) project at its Moomba plant in South Australia to offset greenhouse emissions. The project is expected to begin generating carbon credits in the next 12 months, with the annual capacity of storing up to 1.7 million tonnes of CO2 per year.

Talking about 2024, Santos said it estimates production between 84 million and 90 million barrels of oil equivalent this year, lower than the 91.7 million BOE produced in 2023.

Is Santos a Good Investment?

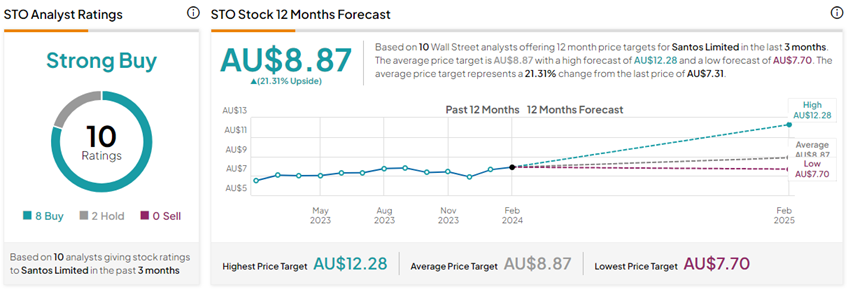

With eight Buys versus two Hold ratings, STO stock commands a Strong Buy consensus rating on TipRanks. The Santos Ltd share price target of AU$8.87 implies 21.3% upside potential from current levels. However, these ratings were given before the announcement of the results and are subject to change.