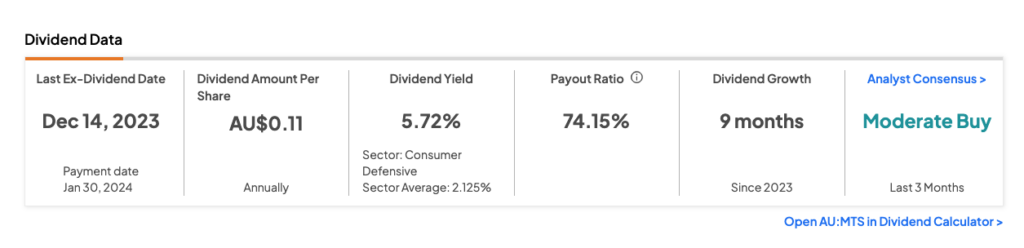

Among the Australian stocks, Metcash Limited (AU:MTS) offers a dividend yield of 5.72%, making it a suitable option for income investors. Metcash has a well-established track record of dividend payments, with its annual dividend per share consistently rising or remaining stable over the last few years. Moreover, MTS’s dividend yield is higher than the Consumer Defensive sector average of 2.1%.

Metcash is a distribution and marketing company engaged in the wholesale supply of food, liqueur, groceries, and other household necessities to retailers.

Income investors, while exploring the ASX, have numerous options for dividend-paying stocks. TipRanks’ dividend tools streamline this tedious process of selecting stocks within a particular market. For instance, the Top Australian Dividend Shares tool compiles a list of the highest dividend-paying companies in Australia, facilitating investment decisions.

Let’s take a look at the details.

How Often Does Metcash Pay Dividends?

Metcash pays dividends twice a year as interim and final, payable in January and August, respectively.

For the first half of FY24, the company announced an interim dividend of AU$0.110, which was in line with the company’s target to maintain a 70% payout ratio. The company has met its payout target for the last three years, from FY21 to FY23. In FY23, the company paid a total dividend of AU$0.225 per share, which was around 5% above the previous year’s payment. This also marked an increase of 80% over the last three years.

Dividends Backed by Earnings Momentum

Metcash’s dividend growth in FY23 was driven by higher earnings and robust financial performance, which continued in the first half of FY24.

In FY23, Metcash witnessed a 6.4% increase in its underlying EPS (earnings per share), reaching 31.8 cents per share. In the first half of FY24, the underlying EPS stood at 14.7 cents per share. The operating cash flow increased by 143% to AU$217.7 million in H1 FY24 compared to the same period a year ago.

Is Metcash a Good Stock to Buy?

On TipRanks, MTS stock has received six Buy and four Hold recommendations. The Metcash share price target is AU$4.14, which is 6.6% higher than current trading levels.