In key news for Australian stocks, Fortescue Ltd (AU:FMG) shares gained over 2% today following the announcement of stupendous half-year results for the six months ending December 31, 2023. The Australian iron ore miner posted a 41% increase in its post-tax profit to $3.33 billion, backed by higher iron ore prices.

Not just that, underlying EBITDA (earnings before interest, tax, depreciation, and amortization) rose 36% year-over-year, while free cash flow jumped by 68% to $2.66 billion. Also, revenue for the six months grew 21% to $9.51 billion compared to last year.

Fortescue’s Strong Results

Fortescue’s management rewarded shareholders with a fully franked interim dividend of AU$1.08 per share, up 44% compared to the same period last year. The key driver of increased profitability was the 24% increase in average revenue to $108.19 per dry metric tonne (dmt).

During the first half of Fiscal 2024, Fortescue mined 105.2 million wmt (wet metric tonne) of ore, down 8% year-over-year, and sold 95.2 million wmt, down 2% compared to H1 FY23. Notably, Fortescue is determined to achieve a target of shipping between 192 million and 197 million tonnes of ore in the Fiscal year through June. In Fiscal 2023, Fortescue shipped 192 million tonnes.

Australia’s largest iron ore miner is also pivoting toward clean energy resources, which generated $26 million in revenue in the six months and made an EBITDA loss of $320 million. Even so, the company plans to spend $500 million on clean energy projects in the current Fiscal year. Overall, management is confident about its pipeline of upcoming projects, particularly in Norway and Brazil.

Is Fortescue a Buy or Sell?

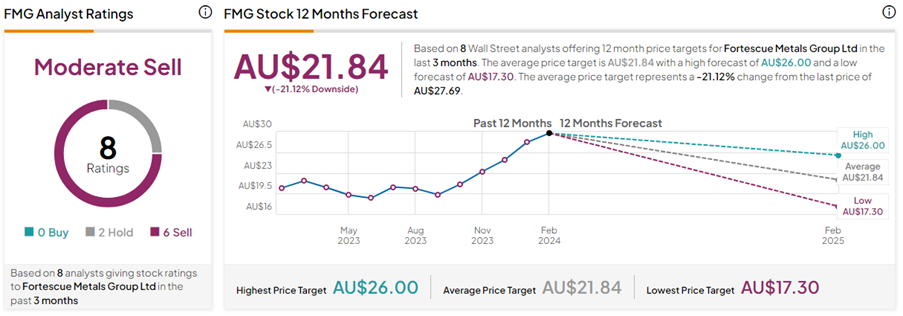

With two Holds versus six Sell ratings, FMG stock has a Moderate Sell consensus rating on TipRanks. The Fortescue Ltd share price target of AU$21.84 implies 21.1% downside potential from current levels.