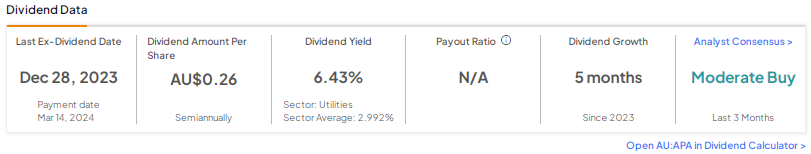

Among the Australian stocks, APA Group (AU:APA) offers a dividend yield of 6.43%, significantly higher than the sector average of 2.99%. The company’s dividends have consistently grown over the last 20 years, positioning it as one of the most stable dividend stocks for income investors. In terms of capital appreciation, analysts are moderately bullish on the stock and predict a small upside.

TipRanks offers various tools to help users find dividend stocks that match their preferences. For instance, the Best Australian Dividend Shares compiles a comprehensive list of high-dividend-paying companies in this market, along with other criteria for users to compare.

APA Group Dividend History

APA Group is a prominent energy infrastructure company that operates and manages a $27 billion portfolio of natural gas, electricity, solar, and wind assets.

For Fiscal 2023, the company distributed a total dividend of 55 cents per share, up from the 53 cents paid in the previous year. In its first-half results for FY24, the company announced an interim dividend of 26.5 cents per share, already paid in March 2024.

Along with the results, the company also confirmed its full-year dividend guidance of 56 cents per share. This marked an increase of 1.8% over FY23, reflecting its commitment to balanced distribution growth.

APA’s Upbeat Outlook

Additionally, APA Group also maintained its underlying EBITDA guidance of AU$1.87-$1.91 billion for the full year. In the first half, underlying EBITDA increased by 5.8% to AU$930 million, driven by its acquisitions and inflation-linked price hike. During this period, free cash flow grew by 12.8% year-over-year to AU$546 million, mainly due to increased earnings. Overall, the company’s balance sheet remains robust, with no debt maturities until 2025.

For Fiscal 2024-2026, the company has an attractive growth pipeline that exceeds $1.8 billion, supplemented by an additional $3 billion Pilbara pipeline.

What is the Target Price for APA?

According to TipRanks’ rating consensus, APA stock has received a Moderate Buy rating based on a total of seven recommendations. The APA Group share price target is AU$9.14, which is 5% above the current price level.