Westpac Banking Corporation’s (AU:WBC) shares are among the most traded on the ASX, despite the share price growth not being impressive. However, the dividends still remain steady, making it a worthy investment option for income investors.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following a negative start to the year, the shares have seen an almost 4% increase in the past three months. Year-to-date, the stock has experienced fluctuations but ultimately closed at a similar price level.

Analysts have mixed views about the stock and have rated it a Hold.

Westpac Banking Corporation is among the major financial institutions in the country, along with being the oldest one. The bank provides a full range of banking and financial services to around 14 million customers.

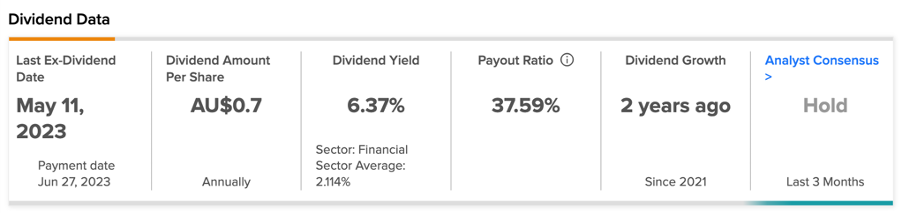

Stable Dividends

The bank is among the top dividend payers on the ASX, with a dividend yield of 6.37%. In May, the company announced its interim dividend of AU$0.7 per share in 2023, which was above the interim dividend of AU$0.61 paid in 2022. The total dividends paid in 2022 were AU$1.25 per share. Australian brokerage firm Morgans expects this dividend to grow to AU$1.49 per share in 2023 and AU$1.52 in 2024.

Analysts’ Opinions

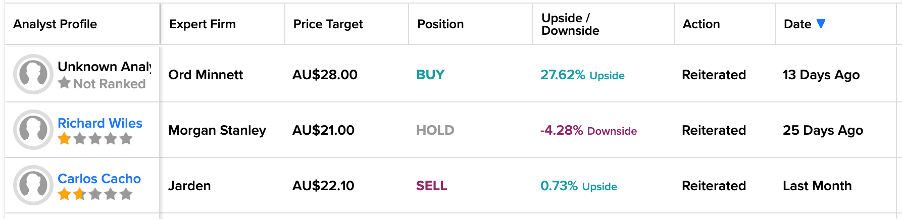

Over the last month, the stock has received mixed ratings from analysts on TipRanks. Most recently, 13 days ago, Ord Minnett reiterated the Buy rating on the stock, predicting a growth of 27.6% in the share price.

On the other hand, 25 days ago, Morgan Stanley analyst Richard Wiles confirmed his Hold rating with a downside prediction of 4%.

Overall, analysts have a cautious approach to the bank’s earnings for the rest of 2023 and 2024, as they believe the interest income has peaked.

Is Westpac a Good Share to Buy?

According to TipRanks’ consensus, WBC stock has received a Hold rating based on one Buy, six Hold, and one Sell recommendations. The average price target is AU$23.17, which is 5.6% above the current price level.

Conclusion

Even though analysts are not confident about the share price growth, the projection of substantial dividend yields for both the current and upcoming years is encouraging.