The share price of the ASX-listed miner IGO Limited (AU:IGO) soared yesterday after the company announced record-breaking numbers and dividends in its FY 2023 earnings. IGO achieved the most robust financial results in its 21-year history, including revenue, EBITDA, net profit, and dividends, in the fiscal year 2023. The company declared a dividend payout of AU$0.74 per share, reflecting a solid performance during the year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Following the release of the results, the shares went up by around 6% yesterday. The IGO share price touched a high point of AU$13.97 yesterday before receding to $13.82 at the end of the trading session today.

Let’s take a look at the numbers.

FY 2023 Results

The company’s revenue was up by 13% to AU$1.02 billion, and net profit after tax jumped by 66% to AU$549 million. The growth was driven by higher production in its lithium business, better-realized prices, and effective cost management. The company also mentioned the remarkable contribution stemming from its investment in the lithium joint venture known as Tianqi Lithium Energy Australia Limited (TLEA) to its earnings. The Greenbushes mine under this joint venture produced 1.49 million tonnes of spodumene in FY 2023. IGO’s production outlook for FY24 anticipates a range of 1.4 to 1.5 million tonnes at the Greenbushes mines.

At the end of FY 23, the company boasted a robust balance sheet, disclosing AU$775 million in cash on June 30th, marking an impressive 111% year-on-year increase. The net debt amounted to AU$415 million.

Talking about the shareholders’ returns, the company declared a fully frank dividend of AU$0.44 per share along with a special dividend of AU$0.16. This led to a full-year payment of AU$0.74 per share, which was a whopping 640% higher than the dividend paid in fiscal year 2022.

Analysts’ Reactions

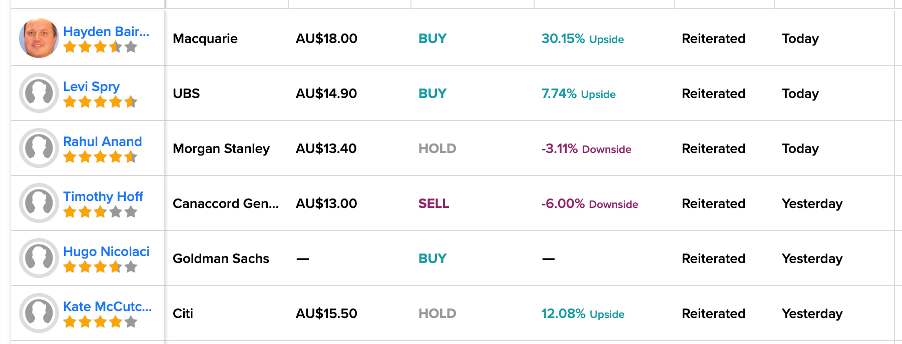

Following the release of the results, a number of analysts have reaffirmed their ratings on the stock, expressing an overall optimistic view.

Today, Hayden Bairstow from Macquarie reiterated his Buy rating on the stock, predicting an upside of over 30% in the price. Bairstow has the highest price target of AU$18.0 on the stock.

On the contrary, analyst Timothy Hoff from Canaccord Genuity has a bearish view of the stock and confirmed his Sell rating yesterday. His price target of AU$13.0 implies a downside of 6% in the share price.

What is the Price Target for IGO?

Based on the analyst consensus from TipRanks, IGO stock has received a Moderate Buy rating, backed by a total of 12 recommendations. This includes six Buy, five Hold, and one Sell rating.

The IGO share price forecast is AU$15.29, which shows a change of 10.5% from the current level.