The FTSE 100-listed AstraZeneca PLC (GB:AZN) lifted its annual profit outlook, backed by its strong portfolio of cancer drugs. The company now anticipates a low-teens percentage increase in its total revenue (excluding COVID drugs), up from the initially guided low double-digit rise. Similarly, the core earnings per share are expected to rise by a high double-digit percentage, a notable adjustment from a low double-digit increase.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company announced its Q3 2023 earnings report with a 13% growth in sales (excluding COVID-19) to $11.49 billion, surpassing estimates. The growth was mainly attributed to the robust sales of its highly successful cancer treatments and consistent demand in emerging markets. This managed to offset the decline in sales of its COVID-19 vaccine and therapy for the third consecutive quarter.

Additionally, the company announced a deal to enhance its presence in the booming anti-obesity market. It acquired an exclusive license for an oral weight-loss drug candidate from China’s Eccogene, for approximately $2 billion.

AstraZeneca is a leading global pharmaceutical company, serving billions of people worldwide. The company operates in three main categories: Oncology, Rare Diseases, and BioPharmaceuticals.

Is AstraZeneca Share a Good Buy?

The company’s shares traded up by 2.3% today at the time of writing.

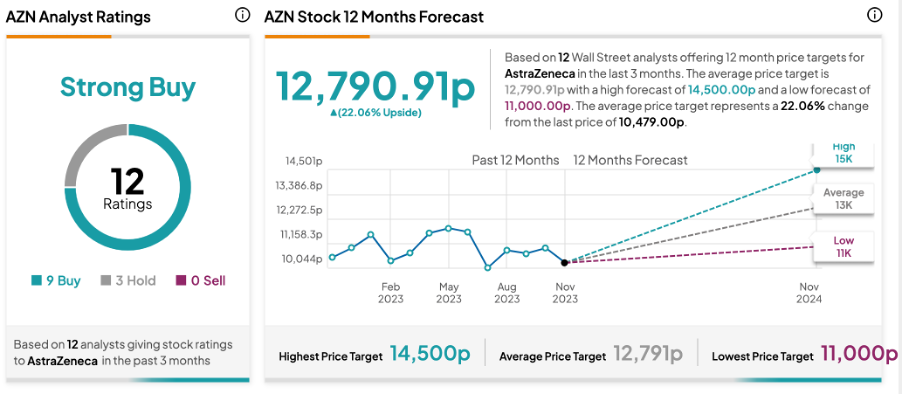

Post-Q3 numbers, analyst Sachin Jain from Bank of America Securities reiterated his Buy rating on the stock today. His price target of 14,500p implies a growth rate of 38.2% in the shares.

As per the consensus rating on TipRanks, AZN stock received a Strong Buy rating, supported by nine Buy and three Hold recommendations. The AstraZeneca share price forecast stands at 12,790.9p, signifying a potential upside of 22% in the share price.