The UK-based equipment rental company Ashtead Group PLC (GB:AHT) reported solid performance in its half-yearly results for FY24, defying its recent profit warning. For the first half, the company reported a 16% increase in group revenue to $5.57 billion. Further, EBITDA grew by 15% to £2.58 billion, driven by higher revenues and operational efficiency.

Among its regions, U.S. revenue surged 18% to $4.8 billion due to an increased volume of used equipment sales. Despite the better-than-anticipated results, Ashtead share price reacted negatively to the announcement and was down by over 4% as of writing.

Ashtead Group provides rental services for a wide range of construction and industrial equipment, catering to various sectors. The company operates in the U.S., the UK, and Canada.

Surpassing Expectations in the U.S.

Last month, the company lowered its annual revenue and profit forecast in its trading update, citing lower demand for its products due to fewer natural disasters in its key markets. This prompted the share to decline by 10% in single-day trading.

However, the half-yearly results reflected the resilience of Ashtead’s North American markets, backed by strong product demand. This is further bolstered by a growing number of projects in the construction industry in the U.S. and recent legislative actions. During the first half, the company added around 74 new locations in North America to capitalize on significant structural growth opportunities.

For the full year, the company expects the U.S. rental revenue to grow between 11% and 13%.

Coming to shareholder returns, Ashtead declared an interim dividend of $0.157, marking a 5% increase on the payment made during the same period in 2022.

Is Ashtead a Good Buy?

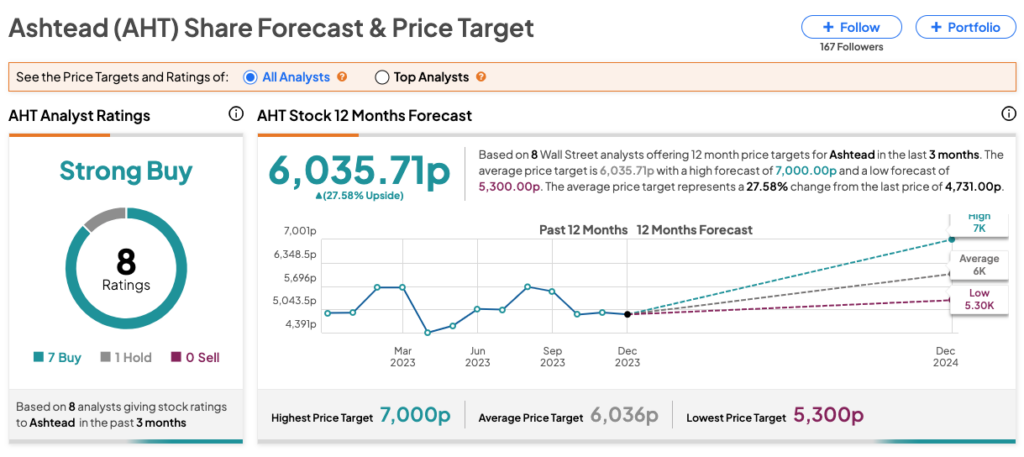

On TipRanks, AHT stock has received a Strong Buy rating based on seven Buys and one Hold recommendation. The Ashtead share price target is 6,035.71p, which is 27.6% higher than the current trading levels.