Australia and New Zealand Banking Group Limited (AU:ANZ) is one of the top four banks in Australia and operates in 30 markets. The stock had grown by more than 70% in the last three years but has fallen by 7% in the last year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

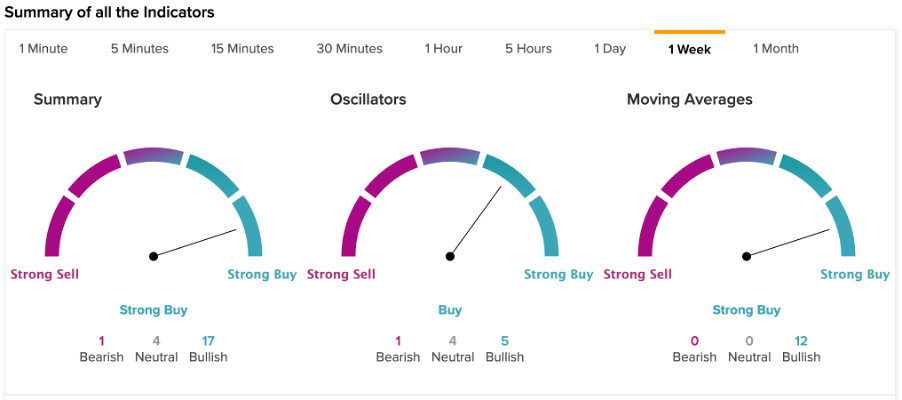

According to the technical analysis on TipRanks, ANZ is a Strong Buy based on the summary signal within a time duration of one week. It includes a Buy signal from oscillators and a Strong Buy from moving averages.

ANZ’s 100-day exponential moving average (EMA) is 23.69, lower than the current share price of AU$24.16, making it a buy. The EMA for shorter durations like 10-days also signals a Buy. However, ANZ’s 100-day simple moving average of 24.62 suggests a Sell.

The RSI (relative strength index) for the stock is 52.09, which implies a neutral action and that the stock is not overbought.

Analysts Opinion

Analysts are placing their bets on ANZ stock considering its higher net interest income, lower dependency on the home loan market, and attractive dividends. The stock carries a dividend yield of 6.79%, much higher than the industry average of 2.1%. In 2022, the bank paid a total dividend of AU$1.46 per share to its shareholders.

Analyst Brendan Sproules from Citigroup predicts that dividends will continue to grow from this point. He expects the total dividend for 2023 to grow to AU$1.66 per share and AU$1.68 per share in 2024. Sproules has a Buy rating on the stock and forecasts a 13% upside in the share prices.

ANZ Share Price Forecast

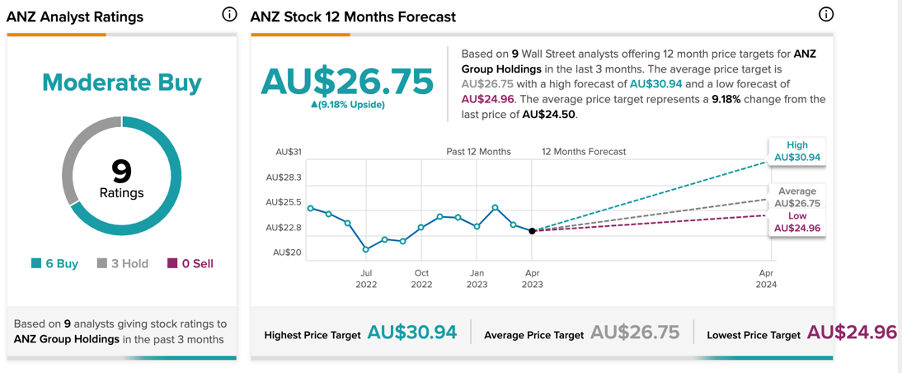

With a total of 9 recommendations, ANZ stock has a Moderate Buy rating on TipRanks. It includes six Buy and three Hold ratings.

The average price target is AU$26.75, which is 9.2% above the current price level.

Ending Notes

With a higher dividend yield, backing from analysts, and a Strong Buy signal from technical indicators, ANZ stock is well-placed for decent growth. On the flip side, rising cost pressure and an uncertain economic environment would remain headwinds for the bank.