Shares of the FTSE 100-listed miners Anglo American PLC (GB:AAL), Rio Tinto (GB:RIO), and BHP Group Limited (GB:BHP) rallied today, gaining over 4%. The surge in prices was driven by J.P. Morgan’s upgraded price targets for these mining companies due to an improved outlook for iron ore. The bank also revised its iron ore price forecasts for the years 2023-2025.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

At the time of writing, Anglo’s shares had surged by 5.34%, Rio’s had risen by 4.5%, and BHP’s had increased by 4.2% on Thursday.

At the start of this year, the bank took a cautious stance on miners with iron ore exposure due to declining steel demand in China and supply improvements. However, the situation has now evolved. China’s steel demand has displayed greater resilience as infrastructure demand has countered the weaker demand in the property sector. These sectors together constitute approximately 30% of China’s steel demand.

The bank added, “With the iron ore market relatively more balanced in the medium term, we raise our 2023-25 iron ore price forecasts by +6%/ +13%/ +17%.”

Let’s take a look at these miners.

What is the Target Price for Anglo American?

Headquartered in London, Anglo American is a leading producer of platinum. The company’s product portfolio also includes diamonds, copper, and iron ore.

J.P. Morgan analyst Dominic OKane maintained his Buy rating on the stock and raised his price target from 2,650p to 2,900p. This implies a 30% upside potential in the share price. The bank mentioned Anglo’s shares as its top pick in the industry due to “stronger value unlock potential.”

Today, the stock also received a Buy rating confirmation from RBC Capital analyst Tyler Broda with a price target of 2,500p.

Two days ago, Barclays analyst Ian Rossouw assigned a Buy rating to the stock, suggesting a growth rate of 30%.

According to TipRanks consensus, AAL stock has a Moderate Buy rating with seven Buy and six Hold recommendations. The Anglo American share price prediction is 2,763.59p, which is 24% above the current trading levels.

Is Rio Tinto a Good Stock to Buy Now?

Rio Tinto is a prominent mining company involved in mineral exploration, extraction, and processing. Iron ore constitutes a substantial portion of the company’s operations and plays a significant role in its revenue generation.

Today, J.P. Morgan analyst Dominic Okane upgraded his rating on the stock from Sell to Hold.

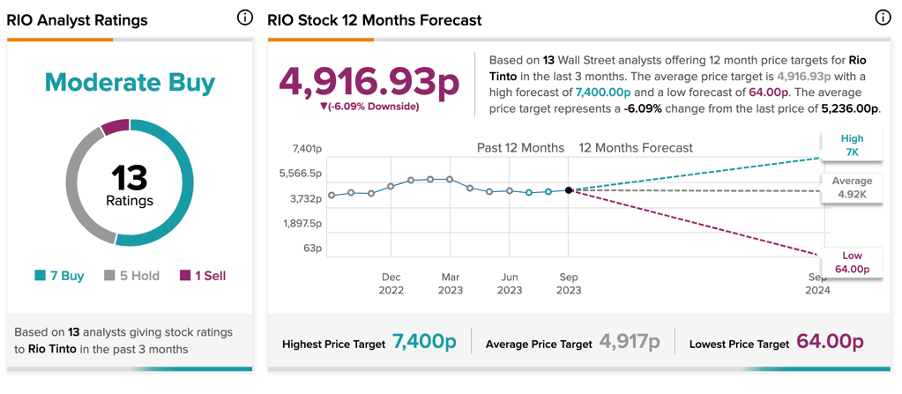

RIO stock has a Moderate Buy rating on TipRanks based on seven Buys, five Holds, and one Sell assigned in the past three months. The RIO share price target is 4,916.93p, which is 6% lower than the current price.

BHP Share Price Forecast

Based in Australia, BHP is a multi-national mining company engaged in extracting and producing a wide range of commodities, including iron ore, coal, copper, nickel, and various other minerals.

Yesterday, analyst Lyndon Fagan from J.P. Morgan reiterated his Buy rating on the stock, predicting a huge upside of 112.9% in the share price.

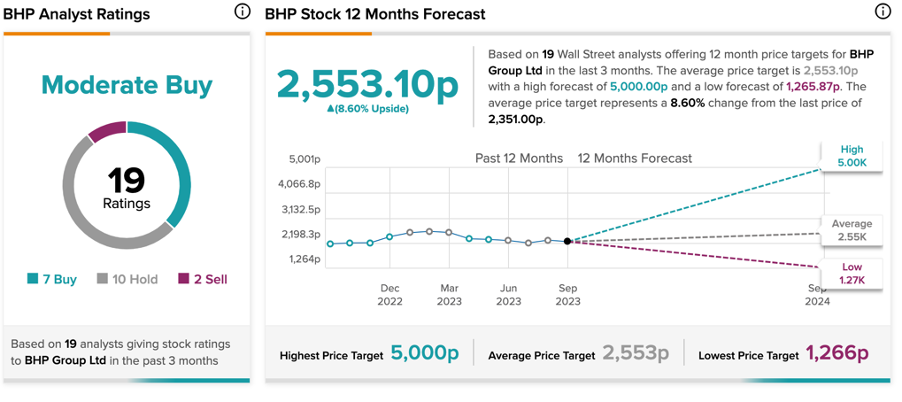

On TipRanks, BHP stock has a Moderate Buy rating based on a total of 19 recommendations, including seven Buy ratings. The BHP share price forecast is 2,553.10p, which is almost 8% higher than the current price level.