SGX-listed companies Genting Singapore (SG:G13) and Singapore Exchange (SG:S68) have received Buy ratings from analysts on TipRanks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Analysts are bullish on their recently reported impressive earnings and also on their stable outlook for the future.

Let’s dig deeper into these two companies.

Genting Singapore Ltd.

Genting Singapore is a leisure company in Singapore engaged in the construction and management of resorts and casinos.

The company stock has been on an upward journey, with a gain of almost 40% in the last year. This was driven by the removal of lockdowns and an overall rebound in the global travel and hospitality sectors.

The company reported its full-year earnings for 2022, with revenues surpassing analysts’ expectations. The yearly revenues were up 62% to S$1.73 billion as compared to 2021. Net income for the company also increased by 86% to S$340.1 million in 2022, up from S$183 million.

Moving forward, the company is confident about a full recovery in 2023 with sustained earnings momentum. The company’s RWS expansion program will be highly supported by the reopening of the China market. Moreover, the addition of a gaming area and other attractions at Sentosa will further drive the company’s revenues by attracting premium customers.

Analysts also expect the company’s dividend to increase to 4 cents per share in 2023, in sync with its earnings growth. The total dividends for 2022 were 2 cents per share.

Is Genting a Good Buy?

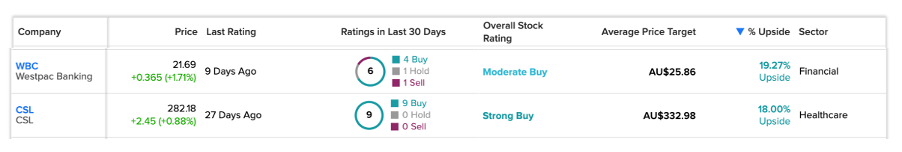

Based on six Buy and four Hold recommendations, G13 stock has a Moderate Buy rating on TipRanks.

The target price of the stock is S$1.13, which has an upside of 10.5% on the current trading level.

Singapore Exchange Ltd.

Singapore Exchange is a trading platform company for securities, derivatives, currency, commodities, and fixed-income products according to the country’s regulations.

In February, the company reported its half-yearly earnings for the fiscal year 2023. The total revenues were up 10% to S$571 million, mainly driven by the derivatives, commodities, and currencies segments. The net profit attributable to equity holders jumped by 30% to S$285 million.

Post-results, analyst Robert Kong from Citigroup reiterated his Buy rating on the stock at a target price of S$10.1, indicating an upside of 16%.

SGX’s well-diversified platform for multiple asset classes will continue to drive more customers and revenues for the company.

Singapore Exchange Share Price Forecast

According to TipRanks’ rating consensus, S68 stock has a Moderate Buy rating with three Buy and four Hold recommendations.

The average target price is S$10.05, which has an upside potential of 15.4% from the current price level.

Conclusion

With a global travel recovery, analysts are optimistic about Genting’s recovery and are projecting higher numbers for 2023.

As for the Singapore Exchange, analysts are happy with the half-yearly earnings and are bullish on the strong fundamentals of the company.

Both G13 and S68 have Moderate Buy ratings on TipRanks.