Allianz SE (DE:ALV) confirmed its operating profit target for FY23 despite a decline in its Q3 profits. The company expects its operating profits to reach around €14.2 billion in 2023. In the third-quarter earnings report, the company’s total volume reached €36.5 billion, reflecting a 4.5% increase. However, the operating profit experienced a decline, falling by 14.6% to €3.5 billion.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The positive revenue growth was mainly due to the positive performance of its property-casualty business, driven by increased prices and volumes. On the flip side, this segment reported an unusually elevated number of claims resulting from natural catastrophes. This impacted the company’s overall operating profit along with its insurance segment’s numbers.

The company’s life/health business segment grew due to robust volumes of single premiums in the U.S.

Allianz’s stock was trading up by 1.71% today at the time of writing.

Based in Germany, Allianz is a globally renowned financial services company with a footprint in over 70 countries. It provides a wide range of insurance and asset management solutions.

Analysts’ Reactions

Post-Q3 results, analysts have expressed their bullish opinions about the stock, confirming their Buy ratings.

Today, analysts William Hardcastle from UBS and Philip Kett from Jefferies reiterated their Buy recommendations on the stock, forecasting a growth rate of around 8%.

Is Allianz Stock a Buy?

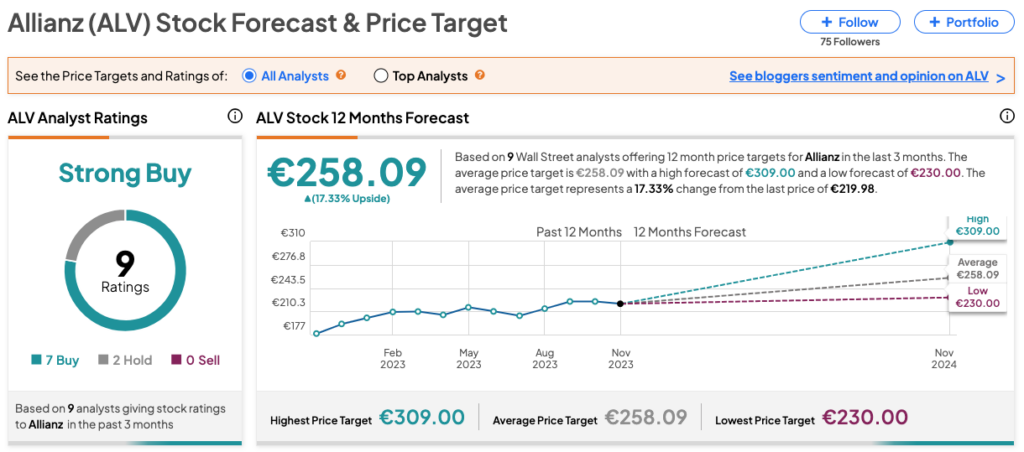

According to TipRanks, ALV stock has received a Strong Buy rating backed by a total of nine ratings, of which seven are Buy. The Allianz share price forecast is €258.09, which is 17.3% higher than the current trading level.