The leading sportswear giant Adidas AG’s (DE:ADS) stock has experienced 50% growth in 2023, taking the top spot on the DAX index. The stock has recovered well after hitting a low point in February, triggered by its split from Kanye West. The rise in Adidas share price was also supported by a huge demand for its brands, Simba, Gazelle, Spezial, and Campus, contributing to growth for Adidas Originals. Despite the prospects, analysts have a neutral stance on the stock and see limited upside potential. Overall, the stock has received a Hold rating from analysts on TipRanks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent Ratings

Today, analyst Richard Edwards from Goldman Sachs confirmed his Hold rating on the stock, with a forecast of 12% upside.

Prior to that, Bernstein analyst Aneesha Sherman upgraded her rating on the stock from Hold to Buy this week, predicting a growth of 7.7%.

Sherman is bullish on the Adidas Terrace shoe range and believes it will be a €1 billion business for the company, driving 3-4% growth in 2024. The company is actively expanding production, aiming to reach over 10 million pairs next year. However, there is also a sense of caution regarding over-distribution.

Improving Outlook

Last month, the company reported its Q3 earnings report with better-than-expected numbers. Revenue increased by 1% on a currency-neutral basis, driven by growth in all regions except North America. Sales in North America declined by 9% due to existing higher inventory levels. Among its categories, footwear sales grew by 6%, while apparel sales declined by 6% in the third quarter.

The company is anticipating only a low-single-digit decline in its revenues compared to the initial projection of a high-single-digit decline. Additionally, it expects a modest operating loss of €100 million, in contrast to the initial projection of an operating loss of €700 million.

Moreover, the company is noticing growing interest in its brand and products across all markets for its Fall/Winter 2024 range.

Is Adidas a Good Share to Buy?

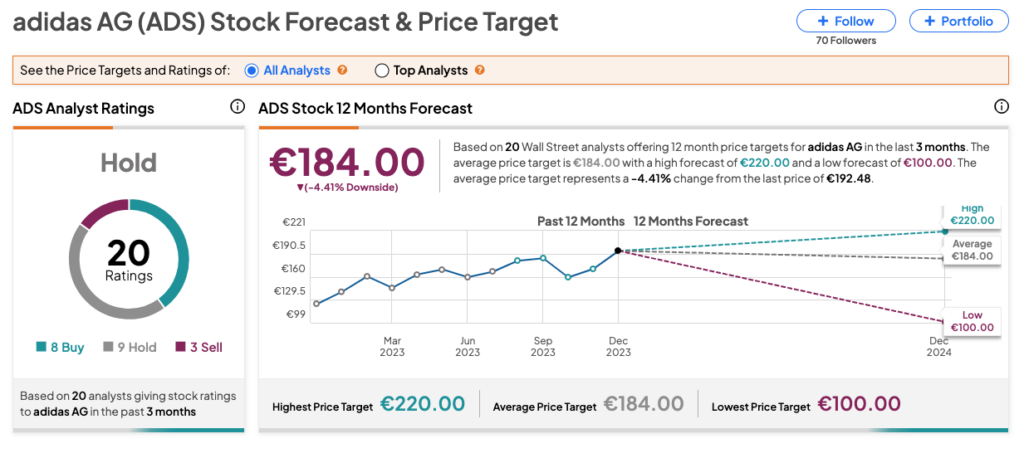

On TipRanks, ADS stock has a Hold Buy rating backed by a total of 20 recommendations. It includes eight Buy, nine Hold, and three Sell ratings. The Adidas share price prediction is €184.0, which is 4.4% lower than the current level.