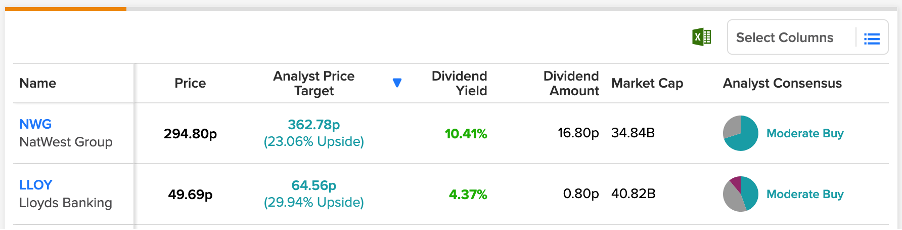

Using the TipRanks tool for Top UK Bank Shares, we have picked up the two banks with the highest dividend yields. The comparison tool from TipRanks makes it convenient for the investor to pick stocks from a particular sector.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Lloyds Banking Group (GB:LLOY) and NatWest Group (GB:NWG) are among the leading banks in the UK market. These banks provide retail and commercial banking services globally. The current economic situation does pose a threat to the banks, resulting in volatile share prices. However, after the 2008 financial crisis, these banks are better prepared this time to face such headwinds.

Let’s have a look at them in detail.

Lloyds Banking Group Plc

As one of the most trusted banks in the UK, Lloyds Bank enjoys a loyal customer base of around 30 million.

The stock is a top pick among investors for its dividends. The bank believes in building strong shareholder returns after stopping dividends during the pandemic. The total dividend for 2021 was 2.0p per share, as compared to 0.57p per share in 2020. The interim dividend for 2022 was 0.8p per share, 20% higher than the 0.67p in 2021.

Moving forward, Citigroup analyst Andrew Coombs expects a total dividend of 2.4p in 2022. Other analysts are also bullish and expect this number to be 2.7p and 3.0 p per share in 2023 and 2024, respectively.

In terms of its income generation, Lloyds is more dependent on its mortgage banking division, which makes it a little more exposed to the risks. The slowdown in the housing market and increasing defaults on home loans remain a concern for the bank. But, the bank’s higher cash reserves and interest income provide the right cushion to sustain its dividends.

Lloyds’ stock has gained around 18% in the last six months, having fallen by 5% in the last year.

What is the Target Price for Lloyds?

The average target price for Lloyds’ stock is 64.56p, which implies an upside potential of almost 30%. The price has a high forecast of 105p and a low forecast of 46p.

Overall, the stock has a Moderate Buy rating on TipRanks, based on four Buy, four Hold, and one Sell recommendations.

NatWest Group Plc

As compared to Lloyds, NatWest has a more diversified base of income streams. NatWest’s stock has outperformed its peers on the stock market, after gaining 21.5% in the last year. In the last six months, the stock has jumped by almost 35%, mostly driven by its good set of third-quarter results.

The bank’s quarterly attributable profit was £187 million. The net interest margin increased by 27 basis points to 2.99% in the quarter. The company expects its net interest income to further increase in 2023.

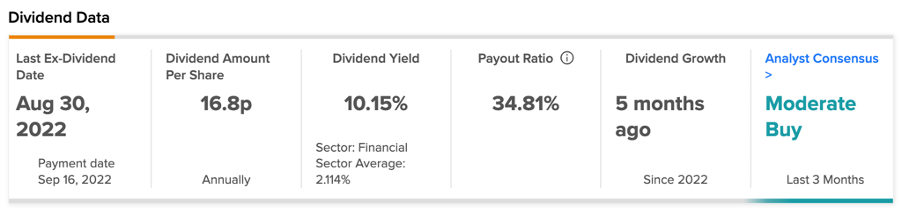

Talking about the dividends, NatWest not only has the highest dividend yield of 10.15% in the UK banking sector but, is also among the highest on the FTSE 100 index. The banking sector’s average dividend yield is 2.1%. Along with an interim dividend of 3.5p per share in 2022, the bank also approved a special dividend of 16.8p per share.

Is NatWest a Good Share to Buy?

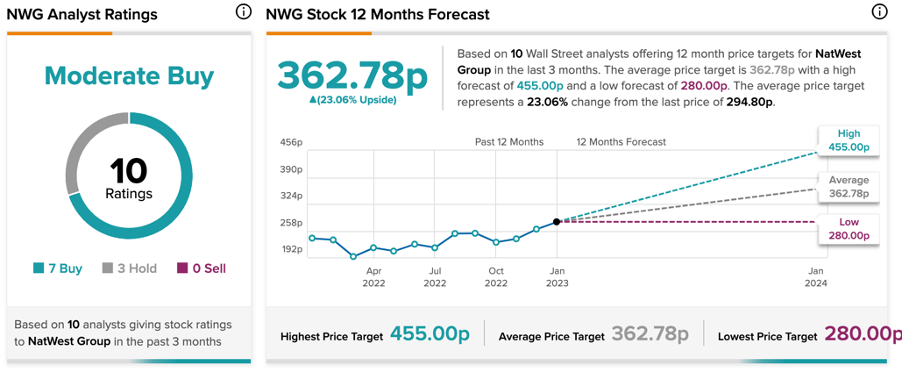

According to TipRanks’ rating consensus, NatWest stock has a Moderate Buy rating, with seven Buy recommendations.

The NWG average target price is 362.8p, which represents a growth of 23.06% on the current price level.

Conclusion

The analysts feel the UK banks have strong cash reserves, which makes them a safe bet during the recessionary environment. The rising interest rates push their income higher, which comfortably covers their dividend payouts.