China-based Alibaba Group Holding Limited (HK:9988) and Xiaomi Corporation (HK:1810) have received Strong Buy ratings from analysts. As per analysts, Alibaba’s share price could see a significant upside potential of 75%, while Xiaomi presents an upside of about 43%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Stocks with a “Strong Buy” rating, filtered with the help of TipRanks’ Database, could generate sustained long-term returns.

Is Hong Kong Market Still in Slump?

In Hong Kong, the Hang Seng index (HSI) monitors the largest companies in the market. So far in 2023, HSI has experienced a decline of around 19%. The market is overall impacted by a slowdown in China, challenges in the property sector, and subdued investor confidence. Analysts see this dip as a chance for investors to buy these two stocks to enhance the long-term potential of their portfolios.

Let’s take a look at the details of these two companies.

Alibaba Group Holdings

Alibaba is a Chinese technology company that operates an online marketplace for retail and wholesale trade. The company is also a dominant player in the field of cloud computing services.

Alibaba’s share price is trading down by over 20% so far in 2023. Investors are cautious regarding the ongoing concerns, such as the delayed turnaround in its e-commerce business and the spin-off of its cloud business.

However, analysts remain highly bullish on the stock, considering its performance in the first half of FY24. Alibaba reported a strong quarter with a 9% year-over-year increase in its revenues to ¥224.79 billion ($30.8 billion), meeting consensus forecasts. Alibaba is well-positioned with substantial resources, boasting $63 billion in net cash at the end of Fiscal Q2.

The company also announced its first-ever dividend since its IPO in 2014. Alibaba’s board of directors has given the green light for the annual cash dividend for fiscal year 2023, set at $0.125 per share.

Is Alibaba a Good Share to Buy?

Overall, 9988 stock has a Strong Buy rating on TipRanks, based on six Buys and one Hold recommendation. The Alibaba share price target is HK$124.34, which shows 76% upside from the current trading price.

Xiaomi Corporation

Xiaomi is a prominent Chinese technology company, renowned for its diverse portfolio of consumer electronics and intelligent devices.

The company recently ended its two-year revenue decline with a robust performance in its third-quarter results for 2023. Xiaomi reported a total revenue of ¥70.9 billion for the quarter. It delivered a substantial increase of over 180% in net income, reaching ¥6 billion.

In Q3, the company also achieved the third position globally in terms of smartphone shipments, with a notable market share of 14.1%.

Is Xiaomi a Good Stock to Buy?

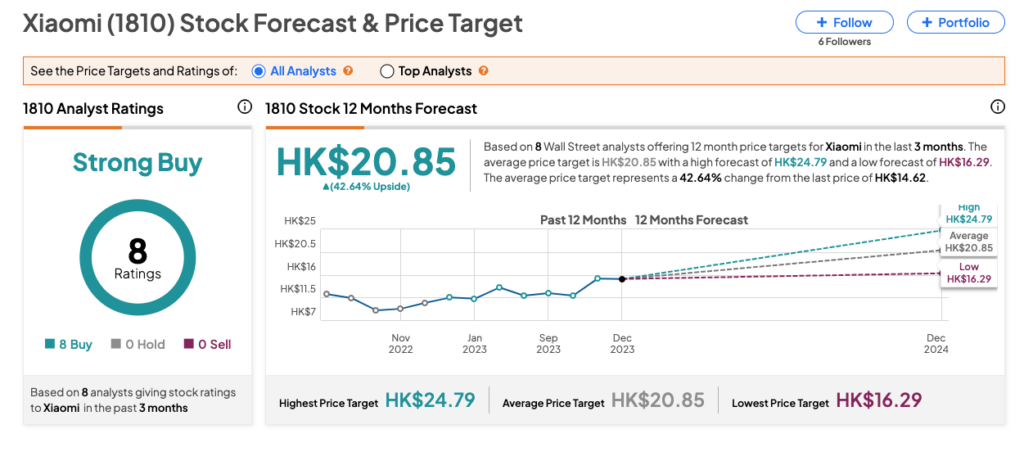

After these strong numbers, many analysts confirmed their Buy ratings on Xiaomi stock while also raising their one-year price targets. These adjustments indicate a positive outlook for the company.

The new Xiaomi share price target stands at HK$20.85, which is 43% above the current price level. On TipRanks, 1810 stock has Buy recommendations from all the eight analysts covering it.