GigaCloud Technology (NASDAQ:GCT), a B2B e-commerce specialist, is in the spotlight, with its share price experiencing immense volatility. Looking at the direction indicated by Wall Street’s average price target, it is advisable for investors to exercise caution as the stock navigates unpredictable terrain.

Growing Rapidly

Established in 2006, El Monte, Calif.-based GigaCloud Technology is a B2B e-commerce specialist delivering end-to-end solutions for large parcel merchandise. Its global platform connects manufacturers and resellers to offer cross-border transaction solutions from manufacturer’s warehouse to doorstep delivery, at one fixed price.

The company has been aggressively expanding, with recent acquisitions including Apexis, Wondersign, and Noble House Home Furnishings.

GigaCloud impressed investors with its Q3 2023 performance, with revenue surging over 39% to $178 million. Moreover, earnings per share (EPS) jumped to $0.59 from $0.01 in the prior-year quarter. The company’s third-quarter performance reflected a rise in demand for large parcel merchandise. Remarkably, average spend per customer rose 28.5% in the 12 months ending September 30, 2023, while active buyers increased 9.6% to 4,602 over the same period. Overall, GCT’s platform is gaining traction.

GCT’s Recent Rollercoaster Ride

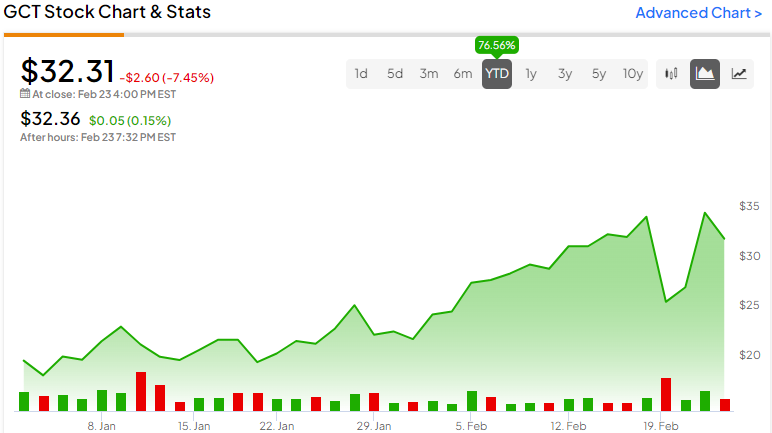

Investors in GCT have been on an incredible journey of late, with the shares up over 531% in the past year.

However, the stock cratered on February 20, with no discernable news driving it. Trading in the shares was briefly halted several times during the day by NASDAQ due to highly volatile price moves in the security. By the end of the day, the stock dropped 34.8% to $25.96.

In the days that followed, however, the stock rebounded and retraced almost all of the lost ground.

Analysts’ Opinions

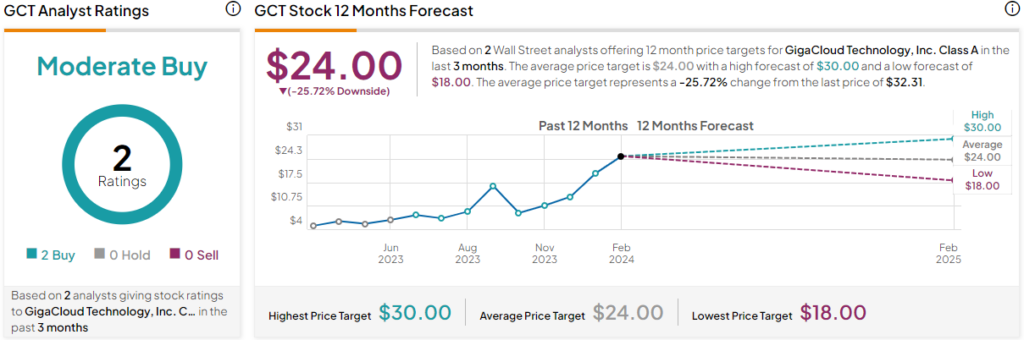

Analysts covering the stock have yet to weigh in on the most recent bout of volatility, though their most recent coverage has been positive.

In late January, CMB International Securities Sophie Huang maintained a Buy rating on GigaCloud, with a price target of $30.

Before that, in early December of last year, Matt Koranda of Roth MKM raised the firm’s price target on GigaCloud to $18 from $16 and reiterated a Buy rating on the shares. He cited the strength of Q3 results highlighted by accelerating top-line growth, driven by first-person sales and healthy marketplace metrics.

What is the Forecast for GCT in 2024?

GCT is currently rated a Moderate Buy based on the ratings from two Wall Street analysts. The average price target is $24, with a high forecast of $30 and a low forecast of $18. The average price target represents about a 26% downside from current levels.

Key Takeaways

In light of recent events, investors should remain cautious about GigaCloud Technology. The business model continues to gather momentum, as demonstrated by the company’s robust acquisitions and strong Q3 results. Analysts’ Moderate Buy rating indicates confidence in the company’s longer-term growth prospects.

However, unpredictability remains a crucial theme in GigaCloud’s recent stock trajectory, and investors should be prepared for continued ups and downs. With the stock currently trading above the consensus average price target, it appears the market fully values GigaCloud’s potential growth.