GFL Environmental Inc. (TSE:GFL) (NYSE:GFL), an environmental services company that offers non-hazardous solid waste management, infrastructure, soil remediation, and liquid waste management services, announced strong Q1-2023 results after market close. Revenue increased by 28.4% to reach C$1.799 billion, surpassing expectations of C$1.677 billion, and adjusted earnings per share (EPS) from continuing operations were C$0.08, beating the consensus estimate of -C$0.04.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, Solid Waste price saw a record 12.6% increase (this refers to the pricing increase for GFL Environmental’s Solid Waste management services), contributing to the company’s growth. Additionally, adjusted EBITDA increased by 24.3% to C$440.5 million, but net losses from continuing operations were C$217.8 million.

Moreover, adjusted cash flows from operating activities came in at C$209.6 million, while adjusted free cash flow was negative, at -C$54.8 million. Nonetheless, CEO Patrick Dovigi noted the company’s double-digit revenue growth and Solid Waste core pricing increase as indicators of robust performance.

GFL’s 2023 Guidance

In the press release, Dovigi also said, “With the strength of our first quarter results, we are well on track to meet or exceed the high end of our full year guidance range and expect to provide a guidance update for our base business when we report our second quarter results.”

For reference, as of last quarter’s report, GFL Environmental expected revenue to range between C$7.55 billion and C$7.65 billion, representing approximately 12.4% year-over-year growth. Also, adjusted free cash flow was projected to reach around C$700 million, with adjusted EBITDA expected to land between C$2.0 billion and C$2.05 billion.

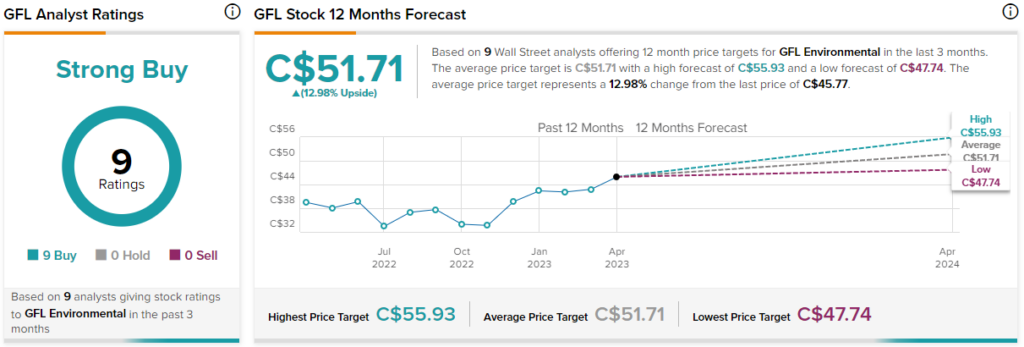

Is GFL Stock a Good Buy, According to Analysts?

According to analysts, GFL stock comes in as a Strong Buy based on nine unanimous Buys assigned in the past three months. The average GFL stock price target of C$51.71 implies 13% upside potential.