Shares of visual content creator and marketplace Getty Images (NYSE:GETY) are down in the double digits today after its preliminary second-quarter numbers lagged estimates with revenue declining 3.3% year-over-year to $225.7 million. While the figure missed estimates by $10.5 million, net loss per share at $0.01 too missed the cut by $0.05.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the business environment remains challenging, Getty is focusing on delivering search improvements through the introduction of natural language search, generative AI, and new AI modification capabilities in its sites.

During the quarter, while both creative revenue and editorial revenue declined by 3.7% and 3.2% respectively, the company’s annual subscription revenue rose to 51.8% as a percentage of total revenue from 48.2% a year ago. Its cash balance at the end of the quarter stood at $121.3 million.

The company is expecting an impact from the macroeconomic pressures, U.S. Hollywood strikes, and litigation costs which are anticipated to be concentrated in H1 2023. Consequently, for the full-year 2023, Getty now expects revenue to hover between $920 million to $935 million versus the prior outlook between $936 million and $963 million. Adjusted EBITDA for the year is seen landing between $292 million and $303 million as compared to earlier guidance between $305 million and $315 million.

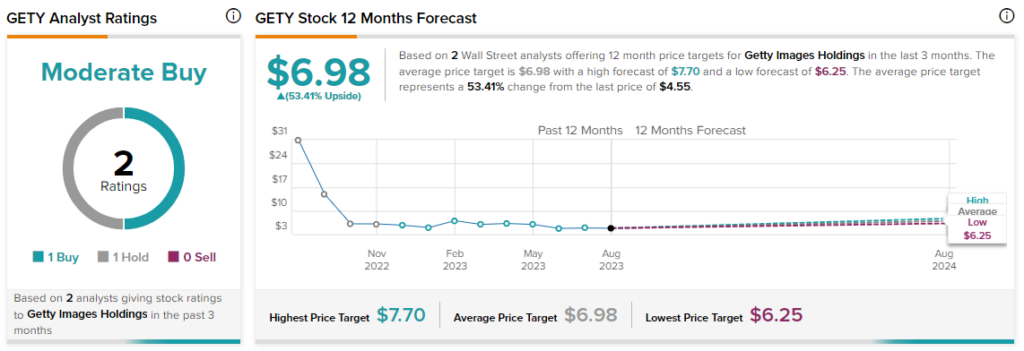

Overall, the Street has a $6.98 consensus price target on GETY alongside a Moderate Buy consensus rating. This points to a substantial 53.4% potential upside in the stock.

Read full Disclosure