An investment world behemoth George Soros has clearly shown his bullish stance in the tech sector. Soros Fund Management is a private American investment management firm founded by George Soros. According to an SEC filing submitted on August 12, the fund took a new position in Tesla (TSLA), buying 29,883 shares worth $20 million. Along with Tesla, George Solos bought up 29.5 million shares of Ford Motor (F).

What is the Future Price of Tesla Stock?

Headquartered in Texas, U.S., Tesla, Inc. manufactures and sells fully electric vehicles, solar energy generation systems, and energy storage products and systems. The company operates through two segments: Automotive and Energy Generation & Storage.

Year-to-date, shares of Tesla lost some of their market value but have begun their recovery, gaining almost 25% in the past 30 days.

On August 5, the EV maker announced a three-for-one stock split. The new shares will come in the form of a stock dividend aimed at making the stock more accessible to more employees and investors.

On August 12, Morgan Stanley analyst Adam Jonas reiterated a Buy rating on Tesla with a price target of $1,150 (27.77% upside potential), following Morgan Stanley’s 4th Annual Intern Survey.

During the first half of the year, Tesla had a whopping 11% market share of all vehicles in California, including hybrids, EVs, and ICE.

According to the survey, though desirability for Tesla has come down, Tesla is “still the most desirable car brand among interns vs. peers.” As a matter of fact, year-to-date, it has sold 50% more vehicles in the US than the total US sales achieved by BMW.

However, the rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average Telsa price target of $876.24 implies 2.65% downside potential to current levels.

Is Ford Stock a Buy, Sell, or Hold?

Like Tesla, Ford shares have begun their upward trajectory, gaining 36% over the past month.

Based in the U.S., Ford is a popular automobile company and is the third largest car manufacturer in the United States. The automaker engages in designing, manufacturing, and selling cars, trucks, sport utility vehicles, Lincoln luxury vehicles, and automobile parts globally.

During FY2021, Ford sold 27,140 EVs in the U.S. compared to 936,172 EVs delivered by Tesla over the same period. Notably, Ford has seen an impressive jump in its EV sales, which grew a whopping 76.6% year-over-year in the month of June 2022.

Further, Ford has an impressive line-up of battery-electric vehicles. Ford Mustang Mach-E, F-150 Lighting pickup as well as many other models will come to the fore in the near term.

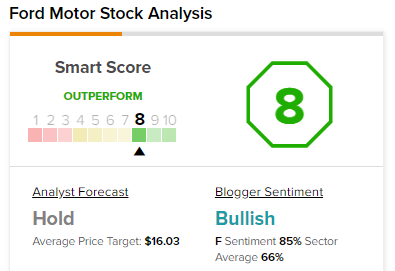

However, according to TipRanks’ analyst rating consensus, Ford is a Hold, based on five Buys, 10 Holds, and one Sell rating. The average Ford price target is $16.03 implying that the shares are fully valued at the current levels.

On a positive note, Ford scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Final Thoughts

The well-known billionaire investor already has a substantial stake in young start-up EV makers, including Rivian (RIVN) and Lucid (LCID).

Soros’ latest move to buy tech stocks, especially EV stocks like Tesla and Ford following their recent rally, may attract the immediate attention of other big and small investors. They may take another look at these stocks and decide to take positions.

Read full Disclosure