General Motors Co. (NYSE: GM) has reported mixed results for the first quarter of 2022. Following the news, shares of the automotive manufacturer rose 2% in Tuesday’s extended trading session.

Results in Detail

Adjusted earnings of $2.09 per share declined 7.1% year-over-year but surpassed analysts’ expectations of $1.68 per share. Revenues stood at $36 billion, up 10.8% year-over-year. However, the figure fell short of consensus estimates of $37 billion.

The company said that it sold 1,427 vehicles worldwide in the first quarter, down from 1,744 vehicles in the same quarter last year.

Outlook

Based on the increased ownership percentage in Cruise, a self-driving car company, and favorable EPS impact of tax consolidation, GM has raised its guidance for adjusted earnings. The company now expects to report adjusted EPS of $6.50-$7.50 in 2022, up from the prior guidance of $6.25-$7.25 per share. The consensus estimate for the same is pegged at $6.72 per share.

Meanwhile, the company has reaffirmed its other forecasts. Net income is expected to be in the range of $9.6 billion to $11.2 billion, while adjusted operating income is anticipated between $13 billion and $15 billion.

Management Weighs In

The CEO of GM, Mary Barra, said, “Launching more EVs faster is the catalyst for growth, and we are accelerating our volumes, growing to 1 million units of EV capacity in North America by the end of 2025, and expanding from there. In North America alone, we target production of 400,000 all-electric vehicles over the course of 2022 and 2023.”

Wall Street’s Take

Two days ago, JPMorgan analyst Ryan Brinkman maintained a Buy rating on GM but lowered the price target to $71 from $75. The new price target implies 86.7% upside potential from current levels.

Overall, the stock has a Strong Buy consensus rating based on 14 Buys and three Holds. General Motors’ average price forecast of $69.69 implies 83.2% upside potential.

Website Traffic

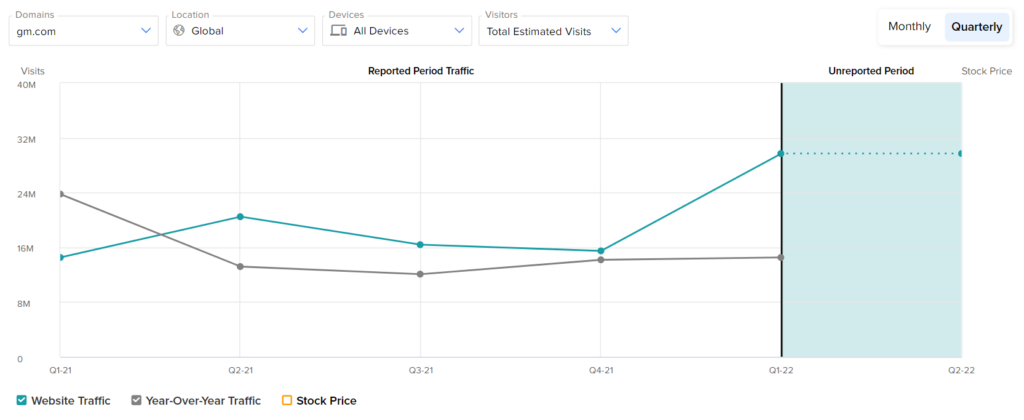

One can predict a company’s performance well ahead of the earnings release with the help of our Website Traffic Tool. According to the tool, in the first quarter, the GM website’s total projected worldwide visits rose 104.6% year-over-year, which is visible in the year-over-year growth witnessed in the revenues for the reported quarter.

Takeaway

The company’s efforts to make a strong footing in the hot EV market with innovative products are likely to support its growth. Further, the bullishness of analysts, along with positive sentiments of hedge funds and insiders, indicates that the company is set to perform well in the future. Thus, investors looking for stocks to pick for their portfolios may find GM interesting.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Read full Disclaimer & Disclosure

Related News:

Why Did Activision Perform Poorly in Q1?

Mondelez Strikes Deal to Strengthen Presence in Mexico

KKR Seeks to Decide Toshiba’s Future