General Motors (NYSE:GM) gained in pre-market trading after the automobile major announced that its Board of Directors had approved a stock buyback worth $6 billion. Additionally, the company raised its dividend by 33% to $0.12 per share in the first quarter.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

The company’s management stated that its “strong revenue growth, margins, and free cash flow,” along with the rising profitability of its traditional automobile and EV business, have enabled it to return cash to its shareholders.

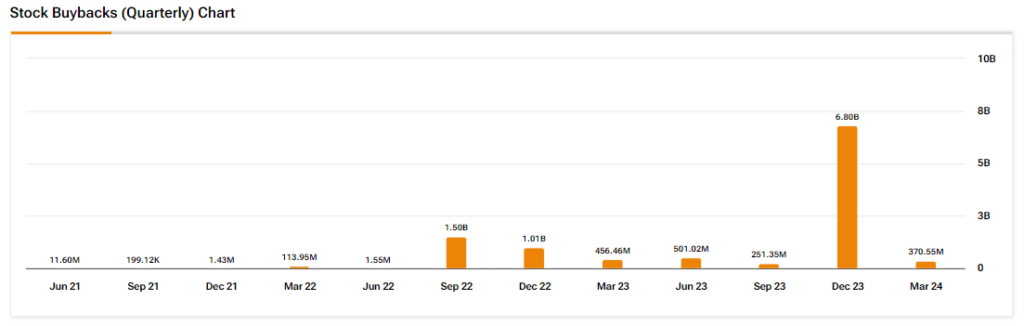

GM’s Stock Buybacks

In November last year, GM announced an accelerated share repurchase of $10 billion. The company had $1.4 billion left from a prior repurchase authorization and repurchased shares worth around $300 million in the first quarter. GM expects to use the remaining $1.1 billion from the previous authorization by the end of the second quarter. The new authorization will enable the company to repurchase more shares after completing the existing authorization.

Overall, in the first half of the year, GM expects to buy back stock worth $1.4 billion and declare dividends worth $0.3 billion. Including the stock buyback and dividends, GM expects to return $1.7 billion to shareholders in the first half of this year.

Is GM a Good Stock to Buy Today?

Analysts remain cautiously optimistic about GM stock, with a Moderate Buy consensus rating based on 12 Buys, three Holds, and one Sell. Year-to-date, GM has increased by more than 30%, and the average GM price target of $56.27 implies an upside potential of 18.3% from current levels.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue