Global automaker General Motors (NYSE:GM) is determined to make a splash in the electric vehicle (EV) market. In the latest move, GM announced that it is lending Australian battery maker Element 25 (AU:E25) a sum of $85 million to set up a plant in Louisiana that will process important input materials for the lithium-ion batteries. Automakers are making notable investments in battery-making companies or raw material suppliers of battery components as a means to support their own supply of batteries for manufacturing EVs. Moreover, these investments are vital to reducing the cost of battery manufacturing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per the Financial Review report, Element 25’s new facility in the U.S. will span 230,000 square feet and process battery-grade manganese sulfate. Per the deal, the Australian company will supply 32,500 tons of these battery input materials to GM for seven years. The company will start building the proposed plant in the quarter ending September 2023, with the full functioning of the plant slated for 2025. GM has previously invested $69 million in Queensland Pacific Metals (AU:QPM), a high-grade nickel and cobalt sulfate supplier.

Commenting on the deal, Doug Parks, GM’s executive VP of global product development, purchasing, and supply chain, said, “GM is scaling EV production in North America well past 1 million units annually, and our direct investments in battery raw materials, processing, and components for EVs are providing certainty of supply, favorable commercial terms and thousands of new jobs.”

Is GM Stock Expected to Rise?

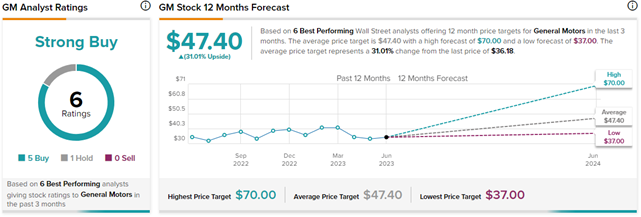

Out of the top six analysts that recently rated GM, five have given the stock a Buy rating and one has given GM a Hold rating. Top Wall Street analysts are those awarded higher stars by TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

Based on these top analysts’ recommendations, the average General Motors price forecast of $47.40 implies an impressive 31% upside potential from current levels. Meanwhile, GM stock has gained 7.5% so far this year.