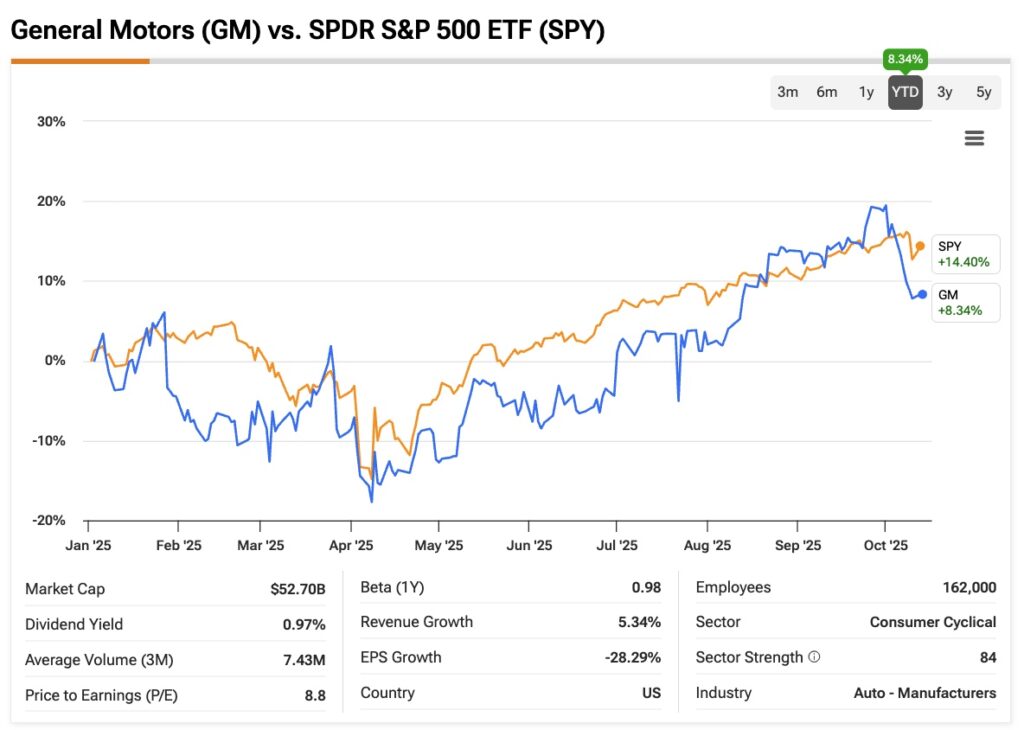

Although it has underperformed the broader market throughout 2025, General Motors (GM) has staged a strong comeback since April as investors have sharply re-rated the stock, assigning a lower risk premium—mainly around tariff impacts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Operationally, the company has been executing well, gaining market share across most regions and delivering margins broadly in line with management targets. Still, signs of weaker cash conversion and tariff headwinds have largely been shrugged off so far, with the stock now trading at forward multiples close to its historical peaks.

With Q3 just around the corner—the Detroit-based automaker is set to report next week on October 21—expectations are for a weak bottom line, pressured by tariff headwinds. That said, upside surprises could emerge if mitigation efforts start to show a clearer path for a stronger second half of 2025.

However, given stretched valuation and how dramatically risk perception has been cut back, I’d rather stay on the sidelines for now and maintain a Hold rating on GM.

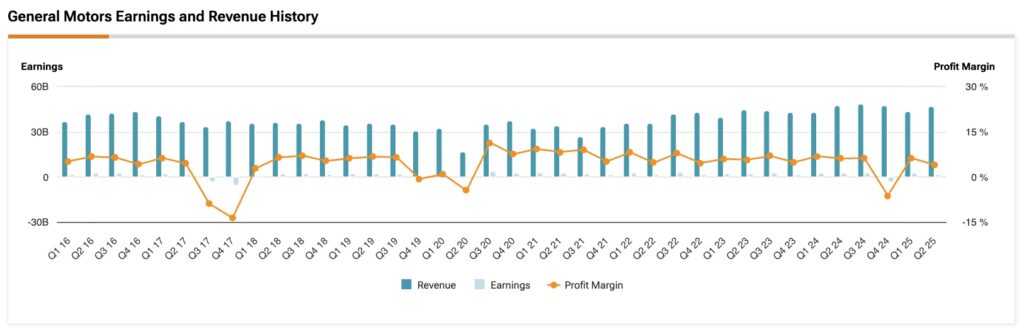

General Motors’ Margin Under Transitory Stress

At the beginning of October, General Motors shares came within a hair of their all-time highs (around $63 per share) set at the end of 2021, briefly breaking above the $60 level before losing momentum. What’s interesting is that the company’s current momentum—especially on the margin front —isn’t nearly as solid as it was between 2020 and 2023, particularly in North America, where most of GM’s profits are generated.

For instance, from 2020—the year the pandemic began—through the next three years, GM consistently delivered operating-adjusted (or EBIT-adjusted) margins in the low double digits, or in the high-single digits at times. More recently, those levels have slid to 6.1%, with the tariff shock being the main culprit.

To put this into perspective, EBIT-adjusted margin is widely viewed as GM’s most crucial profitability metric. It strips out non-recurring items (like major recalls or impairments) and reflects how much the company actually earns from its core automotive operations.

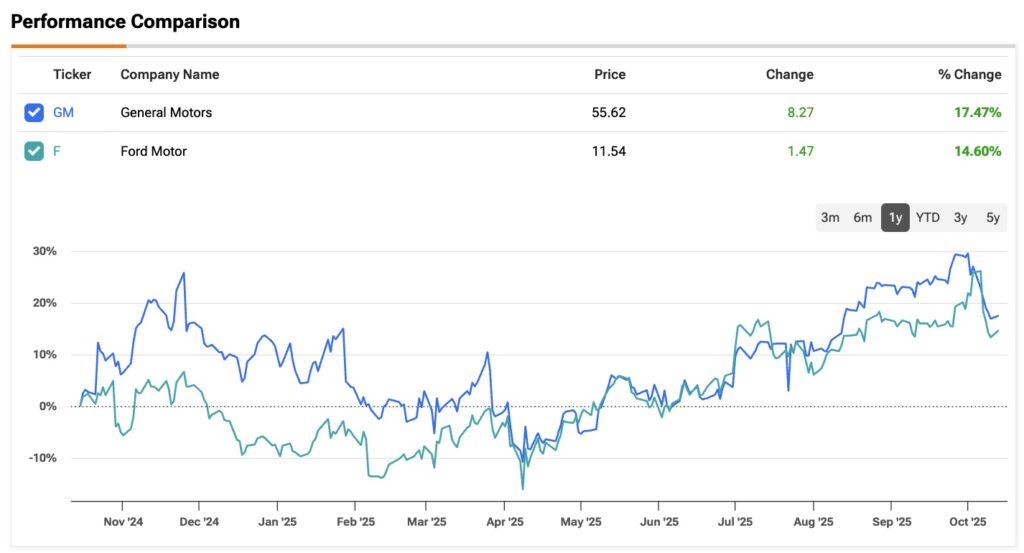

Of course, these headwinds haven’t hit GM alone. When compared to its domestic legacy peer, Ford Motor Company (F), Ford’s EBIT-adjusted margin currently sits at a meager 3.5% for the first half of 2025—a steep drop from 6.1% in the same period a year earlier.

Betting on the Bounce

One might ask: why, even with a sharp drop in its most important operating metric, did GM shares rally strongly, especially since Liberation Day in early April?

In my view, the answer lies in the perception that the margin hit is likely temporary rather than structural. The bull-case narrative for GM—and other car makers—has shifted toward forward earnings. This became especially evident when GM maintained its adjusted EBIT guidance for 2025, despite widespread expectations of cuts. While GM’s adjusted EBIT for fiscal 2024 was $13.7–$15.7 billion, the 2025 guidance now sits at $10–$12.5 billion. Importantly, management highlighted that mitigation measures—including production adjustments, cost initiatives, and price repositioning—could offset roughly 30% of the projected tariff impact on adjusted EBIT.

That said, even though top-line growth is expected to remain flat for at least the next two years, the market is already pricing in EPS growth of ~7% YoY by the end of 2026 and ~3.5% in 2027, signaling that tariff risks are being viewed as cyclical rather than structural.

Looking ahead to Q3, GM will need to report EPS above the $2.29 consensus to beat estimates—a 21.5% drop versus last year—reflecting an 18% reduction in analysts’ forecasts over the past six months due to tariff projections. In H1 2025, automotive operating cash flow fell roughly 37%, impacting cash conversion quality and delaying buybacks. While buybacks slowed down in Q2, they resumed in July, with $4.3 billion still available.

I would keep an eye not just for an earnings beat, but also for any improvement in cash conversion since this could be a key driver for stronger shareholder returns in the second half of the year.

GM’s Market Position and Valuation

The main point of concern in this thesis, in my view, is valuation. Over the past twelve months, GM has been trading at a forward multiple of 5.9x earnings, recently coming down from its all-time highs of 6.5x reached in early October—well above its historical five-year average of 4.7x.

It seems the market has assigned this premium precisely at a time when EBIT-adjusted margins have been severely compressed by tariff headwinds, essentially assuming these pressures are temporary and that double-digit EBIT-adjusted margins will return in due course.

That said, this premium isn’t necessarily unjustified in the current environment. GM and its subsidiaries have gained market share across all regions (except for South America). In North America, for instance, market share in H1 2025 came in at 16.4% versus 15.5% in H1 2024. In APAC, it rose from 4.7% to 4.8% over the same period. Globally, total market share increased from 6.5% to 6.7%.

In other words, GM has continued to expand its presence in a highly competitive auto industry, and there’s a reasonable chance that operating margins will return toward the ~10% target set by management.

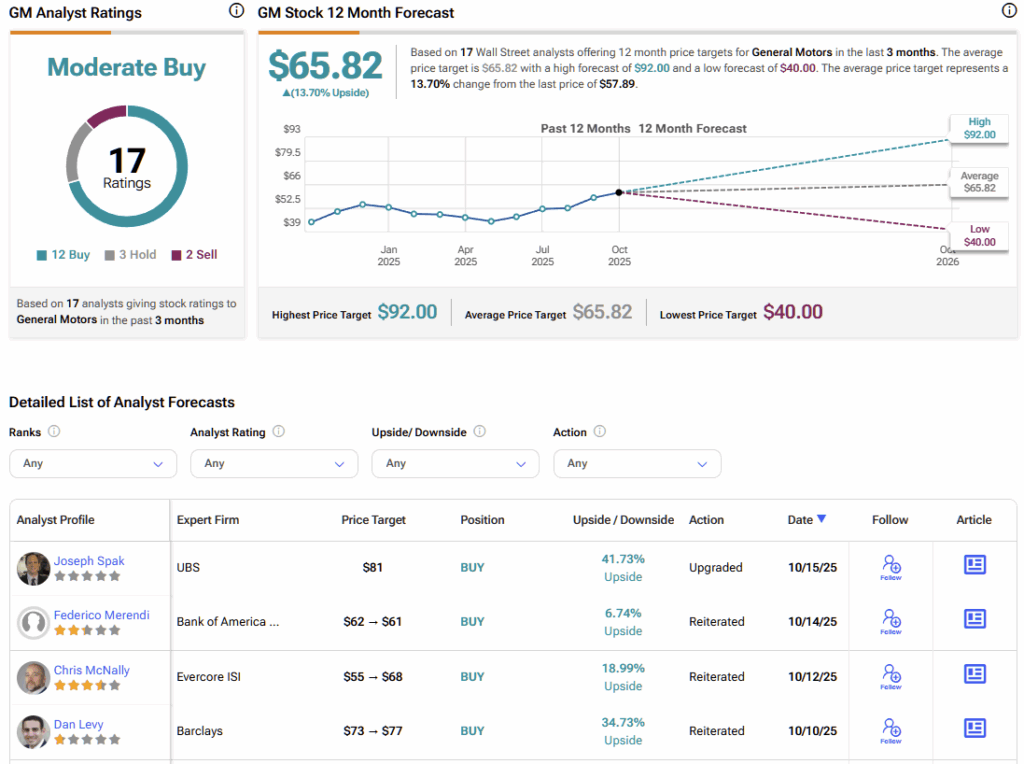

Is GM a Buy, Hold, or Sell?

Consensus on GM stock is moderately bullish. Of the 18 analysts who have rated the stock over the past three months, twelve are bullish, three are neutral, and two are bearish. GM’s average stock price target sits at $65.82, implying an upside of roughly 13.7% over the next twelve months.

Waiting for Margins to Catch Up

I believe there’s a certain degree of exaggerated optimism in the market, driven by the reduced perception of risk around GM’s thesis, especially after the annual lows in April. While there are reasons to justify a premium multiple, I see many uncertainties in assigning it at the current level, given that adjusted EBIT margins are still far from double digits.

Personally, I would feel more comfortable going long GM at a forward earnings multiple closer to 5x—slightly above its historical average—rather than near 6x. For this reason, I am assigning a Hold rating on GM ahead of its upcoming earnings.