General Electric (NYSE:GE) has staged quite a turnaround in recent years. Some suggest that one of the biggest reasons for this comeback is its jet engine operations, which is fueling GE’s 2% rally in today’s trading.

GE is meeting with investors right now to discuss the spin-off of the jet engine business into its own operation, set to take place on April 2 and be renamed GE Aerospace. There’s no shortage of enthusiasm right now for such a move, but GE may find it difficult to produce results on par with that enthusiasm.

However, the projections GE is offering so far don’t seem like they’ll disappoint. It’s looking to turn out $10 billion in operating profit. Given that it expects to bring in $6.4 billion this year, that would be a major surge.

Meanwhile, at GE Vernova

GE’s other business, GE Vernova, will be the other entity formed from the upcoming split. GE Vernova is facing some troubles, particularly its loss-making wind power systems. It plans to make a slate of active improvements, and it’ll have some resources in place to do so. In fact, GE Vernova looks to produce between $700 million and $1.1 billion in free cash flow this year alone. The business also plans to invest $1 billion annually in R&D, though it likely won’t mean good things for profit in the short term.

Is GE Stock a Buy or Sell?

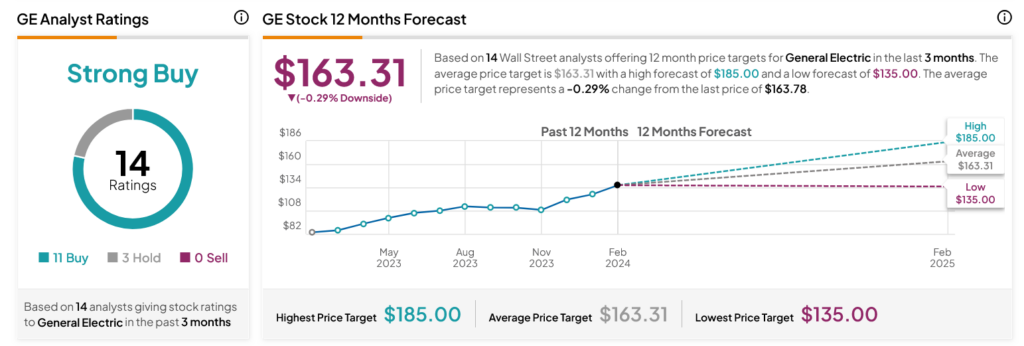

Turning to Wall Street, analysts have a Strong Buy consensus rating on GE stock based on 11 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After an 87.87% rally in its share price over the past year, the average GE price target of $163.31 per share implies 0.29% downside risk.