In this piece, I used TipRanks’ comparison tool below to evaluate two of the three stocks that resulted from the split of the original General Electric conglomerate, GE Aerospace (NYSE:GE) and GE HealthCare Technologies (NASDAQ:GEHC). A closer look suggests bullish views for both, although a clear winner emerges from this pairing upon closer analysis.

After originally announcing its breakup plans in November 2021, General Electric finally completed its split into three companies in early April 2024, when it separated its aerospace and energy businesses. The latter was spun off as GE Vernova (NYSE:GEV), while GE Aerospace, which manufactures and repairs jet engines, retained the “GE” ticker. GE HealthCare, which includes the conglomerate’s medical technology and pharmaceutical diagnostics businesses, was split off and began trading separately in January 2023.

Shares of GE Aerospace have risen by about 3% in the past five days and are up from around $146 on April 2 (the day the conglomerate’s split was complete) to about $154.49 on April 9. Meanwhile, GE HealthCare stock is off 1% over the last five trading days, although it has popped 12.5% year-to-date.

The differing share-price performances come as no surprise because GE HealthCare has been publicly traded for more than a year, while GE Aerospace has just recently split. However, this seems like a good time to examine these two companies to see which might offer better value to shareholders following the split.

GE Aerospace (NYSE:GE)

GE Aerospace lands with far less baggage now that it’s been slimmed down to leave only legacy GE’s assets. In fact, this is an excellent time to be in the airplane repair business, and the company’s plan to dish out up to 75% of its free cash flow to shareholders also bodes well for the future. Thus, a long-term bullish view seems appropriate, especially pending the upcoming earnings release, which could serve as an upside catalyst.

Following the split, GE Aerospace effectively holds the conglomerate’s legacy assets, which include the division that makes and repairs engines for Boeing (NYSE:BA) and Airbus (OTC:EADSF) jets. GE Aerospace broke from the conglomerate’s other two parts with an installed base of about 44,000 commercial engines and about 26,000 military and defense engines. It generated about $32 billion in adjusted revenue in 2023.

Additionally, over 70% of GE Aerospace’s revenues come from services, which is good news for the company’s longevity, especially considering the surging demand for aftermarket services stemming from delays in new jet deliveries by Boeing and Airbus. Those delays are forcing airlines to keep flying older planes longer, which is driving soaring demand for aftermarket services.

With the United Nations expecting international tourism to return to pre-pandemic levels in 2024 and planes staying in service longer, GE Aerospace could see significant upside, especially now that it has far less baggage weighing it down. Last month, GE Aerospace forecast about $10 billion in operating profits by 2028. Morningstar (NASDAQ:MORN) analysts said in a recent note seen by Reuters that they expect the engine business “flywheel to spin off decades of profitable growth.”

Investors may also be pleased with the 250% dividend increase, which brought GE Aerospace’s quarterly dividend to 28 cents per share, although the yield remains below 1% at around 0.72%. We should get more precise information specific to GE Aerospace (versus the GE Vernova part) to calculate the post-separation payout ratio and other important details when the company releases its first earnings report later this month.

However, in March, at an analyst event, the company did share plans to return up to 75% of its free cash flow to shareholders, as mentioned earlier, in share repurchases and dividends following the three-way split, so we should see additional dividend increases over the long term.

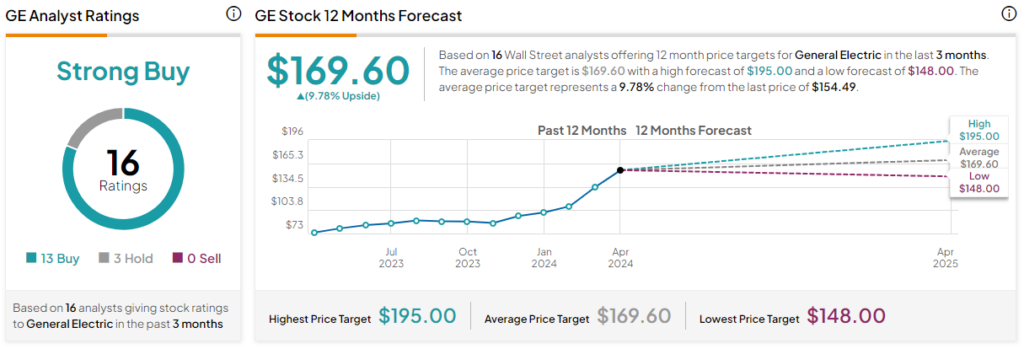

What Is the Price Target for GE Stock?

GE Aerospace has a Strong Buy consensus rating based on 13 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $169.60, the average GE Aerospace stock price target implies upside potential of 9.8%.

GE HealthCare Technologies (NASDAQ:GEHC)

As a medical device maker, GE HealthCare Technologies gets far less of its revenue from services, so it’s no surprise that the company is growing much more slowly than GE Aerospace. Valuing GE HealthCare is challenging because the overall average price-to-earnings (P/E) ratio of the medical equipment industry is skewed higher by the high-growth medtech side of the industry. However, the company has received a few price-target increases recently, suggesting a bullish view might be appropriate.

The medical equipment industry is trading around its three-year average P/E of 56.3x, while GE HealthCare is trading at a P/E of around 28.9x. However, GE HealthCare is growing much more slowly than its medtech counterparts, which warrants a lower multiple.

Medtech can be distinguished from medical devices by the inclusion of always-connected monitoring capabilities. Also, post-split, we can now see that GE HealthCare Technologies is growing much more slowly than GE Aerospace.

While GE Aerospace’s updated outlook for revenue growth in 2024 now stands at the low double digits, GE HealthCare guided for about 4% year-over-year organic revenue growth for 2024. The company also guided for about $1.8 billion in free cash flow for 2024.

Importantly, these numbers show GE HealthCare is still putting up healthy growth, albeit at a relatively slow pace. Given that the company probably won’t be going anywhere anytime soon, it still looks like a long-term buy-and-hold position, although it could take a while for significant share-price appreciation to occur.

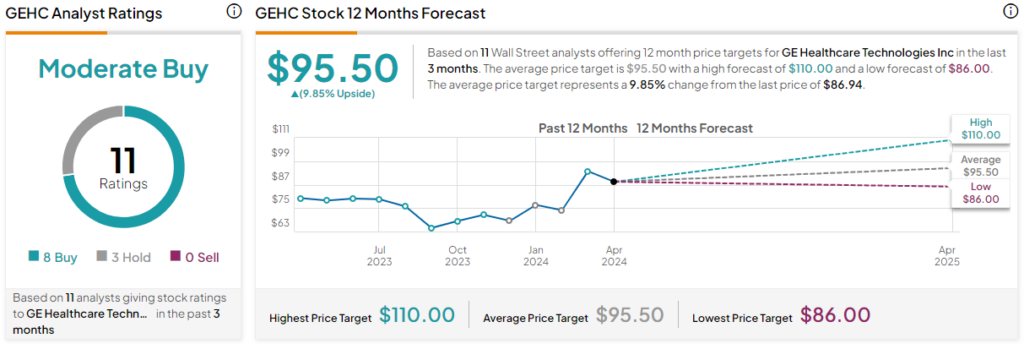

What Is the Price Target for GEHC Stock?

GE HealthCare Technologies has a Moderate Buy consensus rating based on eight Buys, three Holds, and zero Sell ratings assigned over the last three months. At $95.50, the average GE HealthCare Technologies stock price target implies upside potential of 9.9%.

Conclusion: Long-Term Bullish on GE and GEHC

For investors who prioritize growth over other factors, GE Aerospace is easily the winner of this pairing. Additionally, GE Aerospace has pledged to pay up to 75% of its free cash flow to shareholders in the form of dividends and share repurchases, which also makes it more appealing to income investors.