Shares of apparel retailer Gap (NYSE:GPS) surged about 14% in Friday’s pre-market trading, as the company reported an unexpected adjusted earnings per share (EPS) of $0.01 while Wall Street projected a loss per share of $0.15. Significant expansion in the company’s margins helped in driving improved profitability compared to an adjusted loss per share of $0.44 in the prior-year quarter.

Gap’s Q1 FY23 (ended April 29, 2023) adjusted operating margin expanded over 600 basis points, driven by a 570 basis points increase in adjusted gross margin resulting from lower air freight expense and improved promotional activity, partially offset by inflationary headwinds.

The company’s actions to optimize its operating structure are expected to generate $300 million in annualized savings, half of which is expected to benefit selling, general and administrative expenses in the second-half of FY23 and the remainder in the first-half of FY24.

Meanwhile, sales declined 6% to $3.28 billion in Q1 FY23, in line with analysts’ consensus estimate. Comparable sales of Gap, which comprises Gap, Old Navy, Athleta, and Banana Republic brands, declined 3%, with store sales and online sales down 4% and 9%, respectively. The impact of macro pressures on consumer spending, currency headwinds, and the sale of the company’s business in China weighed on the top line in the quarter.

The Road Ahead

Gap expects its Q2 FY23 net sales to decrease in the mid to high-single digit range compared to the prior-year quarter’s net sales of $3.86 billion. It continues to project a low to mid-single digit decline in FY23 net sales.

During the Q1 earnings call, interim CEO Bobby Martin said that the company is simplifying its operating structure and model, bringing down costs, improving speed of decision making, and taking efforts on the creative front to enhance its business. The company continues to search for a new CEO. Chairman Martin assumed the role of the interim CEO when Sonia Syngal stepped down as the CEO amid supply chain challenges and weak sales last year.

Given its cost control measures, including the recently announced layoffs, the company believes that it is well positioned to expand its margins and improve cash flows.

Is GAP a Buy, Hold, or Sell?

Following the results, Guggenheim analyst Robert Drbul said that he was “encouraged” by the company’s Q1 results and the progress made around its inventories. Nonetheless, Drbul maintained his FY23 and FY24 EPS estimates of $0.65 and $1.20, respectively, to reflect a tough consumer and macro environment.

The analyst reiterated a price target of $18 and a Buy rating on GPS stock, as he believe that the company entered 2023 in a healthier and improved competitive position. “Combined with an 8.1% dividend yield, we believe there is significant valuation support at these levels,” said Drbul.

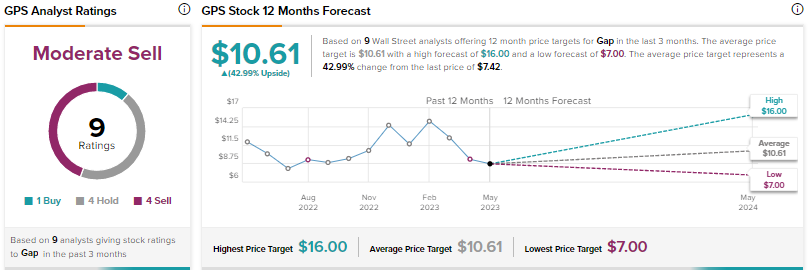

Wall Street’s Moderate Sell rating on Gap is based on one Buy, four Holds, and four Sells. The average price target of $10.61 suggests nearly 43% upside.