American clothing and accessories retailer Gap Inc. (NYSE:GPS) pulled off an unexpectedly solid performance in its third quarter Fiscal 2022 results. Gap’s adjusted earnings of $0.71 per share significantly beat analysts’ expectations of a break-even quarter. Gap reported adjusted earnings of $0.27 per share in the prior year period.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Similarly, net sales of $4.04 billion rose 2% year-over-year and outpaced analysts’ estimates of $3.82 billion. Following the news, GPS stock surged over 10.5% in after-hours trading, extending the gain of 5.6% registered during the day trade on November 17.

Gap’s comparable sales rose 1% year-over-year, with online sales increasing by 5%. Gap has witnessed softness in the kids and baby category and also in the casual wear segment as consumers are spending more on workwear as a necessity. Looking ahead, in Q4, Gap expects net sales to be down in the mid-single digits year-over-year.

Here’s How Gap is Pulling the Strings to Revive its Business

Gap operates high-end lifestyle brands including Old Navy, Gap, Banana Republic, and Athleta, and is the largest specialty apparel company in the U.S. To fight the uncertain macroeconomic backdrop, persistently high inflation, and excess inventory issues, Gap has undertaken steps to reduce expenses by laying off roughly 500 corporate jobs and offering big discounts to get rid of inventory.

Also, Gap is on track to shut down nearly 350 stores of Gap and Banana Republic in North America by 2022 end. Further, Gap even sold its Greater China business to Baozun for $40 million.

Moreover, the retailer recently announced a partnership with Amazon.com (NASDAQ:AMZN) to sell its offerings on the e-commerce portal. Further, the company even terminated its deal with Kayne West due to Ye’s anti-Semitic statements. Gap no longer sells Yeezy-branded hoodies or merchandise.

Is Gap a Buy or Sell?

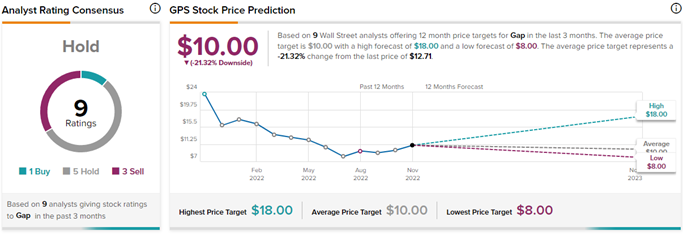

The analysts have a Hold consensus rating on Gap stock as a result of the several headwinds impacting the retail sector currently. The rating is based on one Buy, five Hold, and three Sell ratings during the past three months. On TipRanks, the average Gap price target of $10 implies 21.3% downside potential to current levels. This is over and above the 27.2% value GAP stock has lost so far this year.